Race in Banking and Finance

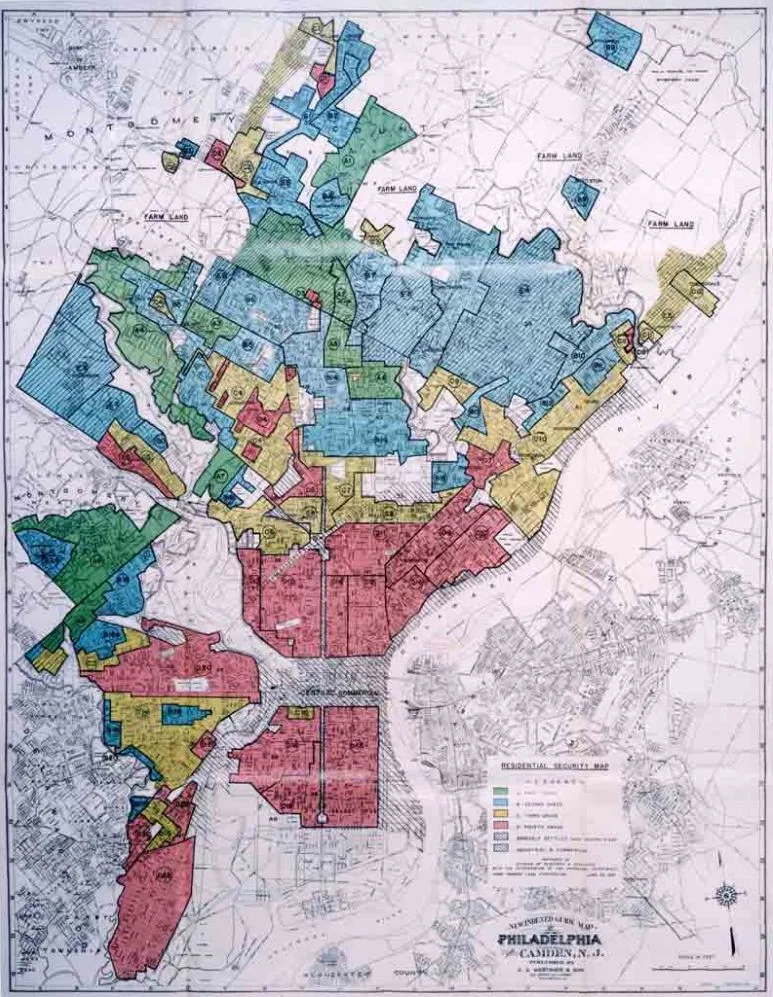

Photograph: Bank redlining map used in residential Philadelphia in 1937. These maps, designed by the Home Owners Loan Corporation (HOLC), devalued black homes by designating black neighborhoods as higher risk. Photo credit: U.S. federal government, Wikimedia Commons.

Introduction

The following resources engage the problem of racism in banking and lending practices. The role of racism in financial practices and institutions needs to be thoroughly examined. See below, or check out our section on general issues with Banks and Finance, which explores moral and ethical problems found primarily in the American financial system.

Conversation Stations

These are the images used in artistic physical displays. They are survey questions and conversation starters that are topically and thematically organized. They demonstrate how Jesus is relevant to each topic or theme. You can also just view the images on your device. If you would like, see all our Conversation Stations; below are the ones that relate to the topic of Race.

Whose Justice? (and instructions and Christian Restorative Justice Study Guide)

Whose Justice? for Harvard Law School

Is a Good Friend Hard to Find? (and instructions and conversation tree)

What Can We Do About Evil? (and instructions and conversation tree) and smaller version and brochure version

Que Podemos Hacer Sobre La Maldad? for the Asociacion Dominicana de Estudiantes Evangelico, 2014

Does the Good Outweigh the Bad? (and instructions)

Race What's the Problem? (and instructions) and brochure version

Messages and Resources on Race, Banking, and Finance

A series of blog posts where we explore many issues as Christian heresy, for which Christians must take responsibility in the frame of repentance. We have designed a study guide to accompany the blog posts. Please consider using it for personal reflection or discussion in your family, church, organization, etc.

Other Resources on Race, Banking, and Finance

Top Articles, Slavery and Finance:

Calvin Schermerhorn, The Business of Slavery and the Rise of American Capitalism, 1815–1860. Yale University Press | Amazon page, Apr 28, 2015.

Zoe Thomas, The Hidden Links Between Slavery and Wall Street. BBC, Aug 29, 2019. Thomas writes:

“By some estimates, New York received 40% of US cotton revenue through money its financial firms, shipping businesses and insurance companies earned. But scholars differ on just how direct a line can be drawn between slavery and modern economic practices in the US. "People in non-slave areas - Britain and free US states - routinely did business with slave owners and slave commerce," says Gavin Wright, professor emeritus of economic history at Stanford University. But he says the "uniqueness" of slavery's economic contribution has been "exaggerated" by some.”

Marina Manoukian, Banks You Didn’t Know Had Ties to Slavery. Grunge, Nov 15, 2021. Previously small banks are now part of larger banks. They include Bank of America, HSBC, Lloyd’s Banking Group, Caisse Des Depots, Barclays, J.P. Morgan Chase, Citibank, Royal Bank of Scotland, Arbuthnot Latham, Truist Financial, Wells Fargo. Sharon Ann Murphy, Banking on Slavery: Financing Southern Expansion in the Antebellum United States. University of Chicago Press, 2023.

Top Articles, Rural communities and finance:

Pete Daniel, Dispossession: Discrimination Against African-American Farmers in the Age of Civil Rights. The University of North Carolina Press | Amazon page, Mar 29, 2013. See review by Vann R. Newkirk II, The Great Land Robbery. The Atlantic, Sep 2019. See 15 minute video by The Atlantic, How Black Americans Were Robbed of Their Land. The Atlantic, Sep 12, 2019.

Top Articles, Urban communities and finance:

Ta-Nehisi Coates, The Case for Reparations. The Atlantic, May 21, 2014. See commentary by Blair L.M. Kelley, ‘The Case for Reparations’ Reignited an Important and Long-Standing Debate. The Root, May 24, 2014. And also Jamelle Bouie, The Crisis in Black Home Ownership: How the Recession Turned Owners Into Renters and Obliterated Black American Wealth. Slate, Jul 24, 2014.

Mehrsa Baradaran, How the Other Half Banks: Exclusion, Exploitation, and the Threat to Democracy. Harvard University Press | Amazon page, Mar 2018. Shows how debt-credit is applied unequally to blacks to exploit them and limit their capital asset building. ACLU, The Racial Wealth Gap and Banking + the USPS. American Civil Liberties Union, May 13, 2021. A short 7 minute video, and ACLU, Your Friendly Neighborhood Bank: The Post Office. American Civil Liberties Union, May 12, 2021. A longer 34 minute video.

Emmanuel Martinez and Lauren Kirschner, A Secret Bias in Mortgage-Approval Algorithms is Denying Minority Borrowers. The Markup | Associated Press | Orange County Register, Aug 25, 2021. “Holding 17 different factors steady in a complex statistical analysis of more than 2 million conventional mortgage applications for home purchases, we found that lenders were 40% more likely to turn down Latino applicants for loans, 50% more likely to deny Asian/Pacific Islander applicants, and 70% more likely to deny Native American applicants than similar white applicants. Lenders were 80% more likely to reject Black applicants than similar white applicants. These are national rates. In every case, the prospective borrowers of color looked almost exactly the same on paper as the white applicants, except for their race.” “In addition to finding disparities in loan denials nationally, we examined cities and towns across the country individually and found disparities in 89 metropolitan areas spanning every region of the country.” Credit scores account for some of the discrimination, but “The CFPB analyzed 2019 HMDA data and found that accounting for credit scores does not eliminate lending disparities for people of color.” See also Amber Ruffin, How Getting Rid of the Credit Score System Fights Racism. The Amber Ruffin Show, Oct 8, 2021. A comedic 6 minute video about how credit scores account for mortgage payments but not rent payments, thus skewing scores for homeowners already.

General Resources

Heller School for Social Policy and Management. Brandeis University. Various papers; see Racial Wealth and Economic Equity

USDA, Black Farmers in America: 1865 - 2000. USDA, Oct 2002.

Dan Immergluck, Redlining Redux: Black Neighborhoods, Black-Owned Firms, and the Regulatory Cold Shoulder. Urban Affairs Review, Sep 1, 2002. finds that black businesses receive fewer and smaller loans, even after accounting for all other variables

Gregory D. Squires, Racial Profiling, Insurance Style: Insurance Redlining and the Uneven Development of Metropolitan Areas. Journal of Urban Affairs, Oct 30, 2003. finds that property insurance firms continue to charge black people higher rates.

Charlie Savage, Countrywide Will Settle a Bias Suit. New York Times, Dec 21, 2011. But Alain Shorter, Why the Feds' Countrywide Settlement Settles Nothing. CBS News, Dec 22, 2011. Victims of the Countrywide scheme will divvy up the $335 million, with some getting a few hundred dollars and others getting several thousand. That amounts to an average of roughly $1,700 per borrower.” Keep in mind: Reuters, Countrywide Exec Gets $28 Million from Bank of America. Reuters, CNBC, Mar 28, 2008. “Bank of America said it has agreed to pay $28 million to Countrywide Financial Chief Operating Officer David Sambol to induce him to run the merged companies' consumer mortgage operations. The amount, which vests over three years, is 37 percent higher than the $20.4 million that Bank of America Chairman and Chief Executive Kenneth Lewis was compensated in 2007 to run the second-largest U.S. bank.”

Laura Ackerman and Don Bustos, Disadvantaged Farmers: Addressing Inequalities in Federal Programs for Farmers of Color. Inst for Agr and Trade Policy, Mar 28, 2012.

Pete Daniel, Dispossession: Discrimination Against African-American Farmers in the Age of Civil Rights. The University of North Carolina Press | Amazon page, Mar 29, 2013. and review by Vann R. Newkirk II, The Great Land Robbery. The Atlantic, Sep 2019. “President Franklin D. Roosevelt’s New Deal life raft for agriculture helped start the trend in 1937 with the establishment of the Farm Security Administration, an agency within the Department of Agriculture. Although the FSA ostensibly existed to help the country’s small farmers, as happened with much of the rest of the New Deal, white administrators often ignored or targeted poor black people—denying them loans and giving sharecropping work to white people… [T]he USDA became the safety net, price-setter, chief investor, and sole regulator for most of the farm economy in places like the Delta. The department could offer better loan terms to risky farmers than banks and other lenders, and mostly outcompeted private credit. In his book Dispossession, Daniel calls the setup “agrigovernment.” Land-grant universities pumped out both farm operators and the USDA agents who connected those operators to federal money. Large plantations ballooned into even larger industrial crop factories as small farms collapsed. The mega-farms held sway over agricultural policy, resulting in more money, at better interest rates, for the plantations themselves. At every level of agrigovernment, the leaders were white.” See 15 minute video by The Atlantic, How Black Americans Were Robbed of Their Land. The Atlantic, Sep 12, 2019. By contrast, a note of hope: Nia-Racquelle Smith, Fannie Lou Hamer's Pioneering Food Activism Is a Model for Today. Food & Wine, Sep 15, 2020. “How a bunch of pigs in rural Mississippi helped secure financial independence for Black families in the 1970s.” “Established in 1967, the Freedom Farm Cooperative (FFC) was an act of resistance. The idea was to provide African Americans with a path to economic opportunity and access to nutritious food that had been systematically denied to them due to white power structures.”

Josie Pickens, The Destruction of Black Wall Street. Ebony, May 31, 2013. re: the Tulsa, OK race riot which decimated the black community there

David Knowles, Bank of America Ordered to Pay $2.2 Million to 1,000 Black Job Seekers It Discriminated Against. New York Daily News, Sep 23, 2013.

Pete Daniel, Farmland Blues: The Legacy of USDA Discrimination. Southern Spaces, Oct 30, 2013.

Ta-Nehisi Coates, The Case for Reparations. The Atlantic, May 21, 2014.

Blair L.M. Kelley, ‘The Case for Reparations’ Reignited an Important and Long-Standing Debate. The Root, May 24, 2014.

Jamelle Bouie, The Crisis in Black Home Ownership: How the Recession Turned Owners Into Renters and Obliterated Black American Wealth. Slate, Jul 24, 2014.

John Light, Ferguson, the Foreclosure Crisis and America’s Hedge-Fund Landlords. Bill Moyers, Sep 5, 2014.

Jacob S. Rugh, Len Albright, and Douglas S. Massey, Race, Space, and Cumulative Disadvantage: A Case Study of the Subprime Lending Collapse. Soc. Problems, May 1, 2015. “describe how residential segregation and individual racial disparities generate racialized patterns of subprime lending and lead to financial loss among black borrowers in segregated cities. We conceptualize race as a cumulative disadvantage because of its direct and indirect effects on socioeconomic status at the individual and neighborhood levels, with consequences that reverberate across a borrower's life and between generations. Using Baltimore, Maryland as a case study setting, we combine data from reports filed under the Home Mortgage Disclosure Act with additional loan-level data from mortgage-backed securities. We find that race and neighborhood racial segregation are critical factors explaining black disadvantage across successive stages in the process of lending and foreclosure, controlling for differences in borrower credit scores, income, occupancy status, and loan-to-value ratios. We analyze the cumulative cost of predatory lending to black borrowers in terms of reduced disposable income and lost wealth. We find the cost to be substantial. Black borrowers paid an estimated additional 5 to 11 percent in monthly payments and those that completed foreclosure in the sample lost an excess of $2 million in home equity. These costs were magnified in mostly black neighborhoods and in turn heavily concentrated in communities of color. By elucidating the mechanisms that link black segregation to discrimination we demonstrate how processes of cumulative disadvantage continue to undermine black socioeconomic status in the United States today.”

Robert Stitt, Wow: High School Students Open an Actual Bank on Campus to Teach Financial Literacy. Financial Juneteenth, Jul 14, 2015.

Alice Ollstein, Bankers Are Buying Baltimore's Debt, Charging Families Crazy Interest Rates, Then Taking Their Homes. Think Progress, Aug 25, 2015.

Alexis Stevens, Fifth Third Bank to Pay $18 Million For Overcharging Black, Hispanics. Atlanta Blackstar, Oct 6, 2015. for auto loans

Paul Kiel and Annie Waldman, The Color of Debt: How Collection Suits Squeeze Black Neighborhoods. ProPublica, Oct 8, 2015.

Sarah N. Lynch, New Jersey's Hudson City Bank to Pay Some $33 Million in Redlining Case. Reuters, Sep 24, 2015.

Paul Langley, Liquidity Lost: The Governance of the Global Financial Crisis. Oxford University Press | Amazon page, 2015. How the labeling of the crisis already prescribed a solution, and how the labeling favored Anglo-Americans and crippled everyone else; this is an excellent study in cultural anthropology; see also book review by Sarah Hall here and Journal of Cultural Economy

Matthew Yglesias, Why Hillary Clinton Is Hitting Bernie Sanders from the Left on Bank Regulation. Vox, Jan 7, 2016. about shadow banks

Paul Kiel, Small Debt is Destroying Black Lives: Institutional Racism and the Wealth Gap America Still Refuses to Acknowledge. Salon, Jan 9, 2016.

John S. Allen, The Big Home Ownership Lie: Greed, Fear, and How the Big Banks Exploited a Human Need. Salon, Jan 9, 2016.

Rob Wile, The Co-Founder of America's Largest Black-Owned Bank Says Racism is Rampant in Finance. Splinter, Jul 28, 2016.

Rachel L. Swarns, Biased Lending Evolves, and Blacks Face Trouble Getting Mortgages. New York Times, Oct 30, 2015. shows that it continues: “In 2014, Hudson approved 1,886 mortgages in the market that includes New Jersey and sections of New York and Connecticut, federal mortgage data show. Only 25 of those loans went to black borrowers. Hudson, while denying wrongdoing, agreed last month to pay nearly $33 million to settle a lawsuit filed by the Consumer Financial Protection Bureau and the Justice Department. Federal officials said it was the largest settlement in the history of both departments for redlining, the practice in which banks choke off lending to minority communities.” Quoted by Wikipedia, Institutional Racism (Wikipedia)

Dan Carter, Race's Role in Predatory Lending. Shared Justice, Sep 12, 2016.

Mehrsa Baradaran, The Color of Money Black Banks and the Racial Wealth Gap. Harvard University Press, Sep 2017. helpful list of resources and summaries; see also an interview with Professor Baradaran by Emma Roller, How the U.S. Government Locked Black Americans Out of Attaining the American Dream. Splinter, Oct 11, 2017.

Amy Goodman, Kept Out: Banks Across US Caught Systematically Rejecting People of Color for Home Loans. Democracy Now, Feb 15, 2018. and Aaron Glantz and Emmanuel Martinez, For People of Color, Banks Are Shutting the Door to Homeownership. Reveal News, Feb 15, 2018. and Aaron Glantz and Emmanuel Martinez, Kept Out: How Banks Block People of Color From Homeownership. Associated Press, Feb 15, 2018.

Mehrsa Baradaran, How the Other Half Banks: Exclusion, Exploitation, and the Threat to Democracy. Harvard University Press | Amazon page, Mar 2018. shows how debt-credit is applied unequally to blacks to exploit them and limit their capital asset building.

Zach Carter, A Dozen Democrats Want To Help Banks Hide Racial Discrimination In Mortgages. Huffington Post, Mar 1, 2018.

Elizabeth Warren, Banking's Racist Past. Reflect, Mar 13, 2018. 10 minute speech on the Senate floor; see Emily Stewart, The Bank Deregulation Bill the Senate Just Passed. Reflect, Mar 14, 2018. See Bartlett Taylor, Bank Lobbyist Act Update. Citizen Vox, Mar 28, 2018.

Michael Harriot, Doug Jones and the Democratic Party Just Screwed Black Voters ... Again. The Root, Mar 15, 2018. and Ryan Cooper, The Subtle Racism of Centrist Democrats. The Week, Mar 9, 2018.

Arielle Gray, I Couldn’t Afford To Pay My Student Loans. Then I Received A Warrant For My Arrest. Huffington Post, Jun 22, 2018. highlights many of the dangers of student loan arrangements

Racist American History, The Racist History of Banking. Splinter, Jul 11, 2018. how black Americans were systematically discriminated against through our financial system

Brent Staples, A Fate Worse Than Slavery, Unearthed in Sugar Land. New York Times, Oct 27, 2018. "Bodies of sugar cane workers recently discovered in Texas reveal gruesome details about the convict leasing system"

Renae Merle, Wells Fargo Admits It Incorrectly Foreclosed on 545 Homeowners It Should Have Helped. Washington Post, Nov 6, 2018.

Michael Herriot, #BankingWhileBlack: Bank Calls Cops on Man Because His Paycheck Was Too High. The Root, Dec 18, 2018.

Mehrsa Baradaran, The Color of Money: Black Banks and the Racial Wealth Gap. Harvard University Press | Amazon page, Mar 11, 2019.

Jessica Bennett, Chase Bank Calls Cops on Black Mayor in His Own City. Ebony, May 6, 2019.

ATTOM Staff, Seriously Underwater U.S. Properties Increase From A Year Ago. ATTOM Data Solutions, May 7, 2019.

Adam Harris, What Happens When a Billionaire Swoops In to Solve the Student-Debt Crisis. The Atlantic, May 19, 2019. “A philanthropist surprised Morehouse College graduates at commencement by announcing he would pay off their student loans. But one person—even a very generous one—can only do so much.”

Mark Whitehouse, Black Poverty Is Rooted in Real-Estate Exploitation. Bloomberg, Jun 17, 2019. “A new study in Chicago shows how the dream of homeownership was converted into a poverty trap.” Practices such as “contract for deed” were based on predatory financing, where black families were overcharged between $3.2 - 4.0 billion, benefiting mostly white real estate agents and investors. The FHA scandal of the 1970’s led to widespread foreclosures.

Richard Walker, The New Deal Didn’t Create Segregation. Jacobin Magazine, Jun 18, 2019. critiques Richard Rothstein’s account of history as too narrow; “Housing segregation, like racism in general, has deep roots in American society. It wasn’t imposed by the federal government — and certainly not by the New Deal.”

Tessa Stuart, Ta-Nehisi Coates Dismantles Mitch McConnell’s Remarks on Reparations. Rolling Stone, Jun 19, 2019.

Chris Linski, Rental Price Burden In Mass. Surpasses New York And D.C., Report Finds. WBUR, Jun 19, 2019. focuses on wages, but should also include indebtedness

Elena Botella, I Worked at Capital One for Five Years. This Is How We Justified Piling Debt on Poor Customers.. New Republic, Oct 2, 2019. “The subprime lending giant is a textbook case in creating a corporate culture of denial.”

Amy Goodman and Aaron Glantz, Homewreckers: How Wall Street, Banks & Trump’s Inner Circle Used the 2008 Housing Crash to Get Rich. Democracy Now, Oct 15, 2019. See also Aaron Glantz, Homewreckers: How a Gang of Wall Street Kingpins, Hedge Fund Magnates, Crooked Banks, and Vulture Capitalists Suckered Millions Out of Their Homes and Demolished the American Dream. Custom House | Amazon page, Oct 15, 2019.

Keeanga-Yamahtta Taylor, Race for Profit: How Banks and the Real Estate Industry Undermined Black Homeownership. The University of North Carolina Press | Amazon page, Oct 21, 2019.

Emily Flitter, This Is What Racism Sounds Like in the Banking Industry. New York Times, Dec 11, 2019. “A JPMorgan employee and a customer secretly recorded their conversations with bank employees.”

John Iadarola and Jayar Jackson, Minority Graduates Targeted In MAJOR College Scandal. The Damage Report, Feb 12, 2020. higher rate loans given to students going to HBCU’s and colleges in more Latino areas

Pew Charitable Trusts, How Debt Collectors Are Transforming the Business of State Courts. Pew Charitable Trust, May 6, 2020. “Lawsuit trends highlight need to modernize civil legal systems”

Christine Percheski and Christina Gibson-Davis, A Penny on the Dollar: Racial Inequalities in Wealth among Households with Children. American Sociological Association, Jun 1, 2020. and summary by Paul Caine, Study: Black Families Have 1 Cent for Every Dollar White Families Have. WTTW, Jun 10, 2020.

Jeremy Kahn, Lloyd’s of London, Other Companies Agree to Pay Slavery Reparations After George Floyd Protests. Fortune, Jun 8, 2020.

Roberto Lama, Systemic Racism: How Meritocracy is Misused to Ignore It. Roberto Lama, Jun 18, 2020. Lama’s 8.5 minute video explores housing and redlining, the wealth gap, implicit bias in the workplace. Lama provides helpful links to other studies.

USA Facts, White People Own 86% of Wealth and Make Up 60% of the Population. USA Facts, Jun 25, 2020. “White wealth is diversified among real estate, equities, and other assets, whereas non-white wealth is mostly in pensions and real estate.”

Tom Philpott, White People Own 98 Percent of Rural Land. Young Black Farmers Want to Reclaim Their Share. Mother Jones, Jun 27, 2020. “Innovations by Black farmers remain at the core of sustainable agriculture today.”

Patrick Rucker, Trump Financial Regulator Quietly Shelved Discrimination Probes Into Bank of America and Other Lenders. ProPublica, Jul 13, 2020. “At least six investigations into discriminatory mortgage loan “redlining” have been halted or stalled — against staff recommendations — under the Trump administration’s Office of the Comptroller of the Currency.”

Robert Reich, Corporate Hypocrisy on Racism. Robert Reich, Jul 14, 2020. re: Goldman Sachs, other Wall Street financiers who profit from for-profit prisons, WalMart, etc.

Ivana Davidovic, The Frustration of Trying to Invest in My Hometown. BBC, Jul 26, 2020. banks appraise black neighborhoods and business zones lower, sometimes dramatically so. This means that equity investments are less available and smaller. See also Andre M. Perry, Jonathan Rothwell, and David Harshbarger, The Devaluation of Assets in Black Neighborhoods. Brookings Institute, Nov 27, 2018. and Andre Perry, Homeowners Have Lost $156 Billion by Living in a “Black Neighborhood”. CNN, Dec 7, 2018. find that even controlling for housing quality, levels of schools and crime, houses in black neighborhoods are worth $48,000 less than houses in white neighborhoods. And Debra Kamin, Black Homeowners Face Discrimination in Appraisals. New York Times, Aug 25, 2020. “Companies that value homes for sale or refinancing are bound by law not to discriminate. Black homeowners say it happens anyway.” Multiple examples of it.

Michelle Singletary, Credit Scores Are Supposed to Be Race-Neutral. That’s Impossible.. Washington Post, Oct 16, 2020. “Blacks must make extraordinary efforts to overcome the discrimination that is often hidden in financial policies or products that are supposed to be bias-free.” Link to racial disparity in debt collections, see Pew Charitable Trusts, How Debt Collectors Are Transforming the Business of State Courts. Pew Charitable Trust, May 6, 2020. “Lawsuit trends highlight need to modernize civil legal systems”

Charlene Crowell, COVID Worsens Debt Harassment. Bay State Banner, Nov 11, 2020. “On Oct. 30, the Consumer Financial Protection Bureau (CFPB) released its 653-page regulatory revision for enforcement of the Fair Debt Collection Practices Act (FDCPA), originally enacted in 1977. Since that time, the debt collection industry has grown into a multi-billion industry with over 8,000 firms throughout the country… The largest portion of debt in communities of color are for medical services and student loans… In addition, the CFPB’s own 2017 survey found that 44% of borrowers of color reported having been contacted about a debt, compared to 29% of white respondents. Even when accounting for differences in income, communities of color are disproportionately sued by debt collectors. In fact, 45% of borrowers living in communities of color faced litigation, while only 27% of similarly situated consumers in white areas were sued.”

ACLU, The Racial Wealth Gap and Banking + the USPS. American Civil Liberties Union, May 13, 2021. a short 7 minute video, and ACLU, Your Friendly Neighborhood Bank: The Post Office. American Civil Liberties Union, May 12, 2021. is a longer 34 minute video

Joint Economic Committee of Congress, Hearing: Examining the Racial Wealth Gap in the United States. Joint Economic Committee, May 12, 2021. features panelists Dorothy Brown (21:05) on tax policy’s impact on increasing the racial wealth gap, including (42:12) caring for family members who lived during Jim Crow and greater debt; Darrick Hamilton (26:30) on the financial system, Mehrsa Baradaran (31:45) on the financial and housing systems, and Ian Rowe (37:25) on educational systems.

Emmanuel Martinez and Lauren Kirschner, A Secret Bias in Mortgage-Approval Algorithms is Denying Minority Borrowers. The Markup | Associated Press | Orange County Register, Aug 25, 2021. “Holding 17 different factors steady in a complex statistical analysis of more than 2 million conventional mortgage applications for home purchases, we found that lenders were 40% more likely to turn down Latino applicants for loans, 50% more likely to deny Asian/Pacific Islander applicants, and 70% more likely to deny Native American applicants than similar white applicants. Lenders were 80% more likely to reject Black applicants than similar white applicants. These are national rates. In every case, the prospective borrowers of color looked almost exactly the same on paper as the white applicants, except for their race.” “In addition to finding disparities in loan denials nationally, we examined cities and towns across the country individually and found disparities in 89 metropolitan areas spanning every region of the country.” Credit scores account for some of the discrimination, but “The CFPB analyzed 2019 HMDA data and found that accounting for credit scores does not eliminate lending disparities for people of color.”

Amber Ruffin, How Getting Rid of the Credit Score System Fights Racism. The Amber Ruffin Show, Oct 8, 2021. for a 6 minute video about how credit scores account for mortgage payments but not rent payments, thus skewing scores for homeowners already

Second Thought, Why The American Credit System Is So Terrible. Second Thought, Nov 19, 2021. Explains why the credit system reproduces the system of racially segregated housing; provides many resources and links.

Francisco Perez, How Do We Build Black Wealth? Understanding the Limits of Black Capitalism. Non-Profit Quarterly, Apr 27, 2022. Why “Black Capitalism” has failed to produce more racial equality economically.

Ken Sweet, US Says Warren Buffett’s Mortgage Company Redlined in Philadelphia. Associated Press | Boston Globe, Jul 27, 2022. “A Pennsylvania mortgage company owned by billionaire businessman Warren Buffett discriminated against potential Black and Latino homebuyers in Philadelphia, New Jersey and Delaware, the Department of Justice said Wednesday, in what they are calling the second-largest redlining settlement in history. Trident Mortgage Co., a division of Berkshire Hathaway, deliberately avoided writing mortgages in minority-majority neighborhoods in West Philadelphia; Camden, New Jersey; and in Wilmington, Delaware; the DOJ and the Consumer Financial Protection Bureau said in their settlement with Trident. As part of the agreement with the DOJ and the CFPB, Trident will have to set aside $20 million to make loans in underserved neighborhoods.”

Michael Anson and Michael D. Bennett, The Collection of Slavery Compensation, 1835 - 43. Bank of England, Nov 25, 2022.

James Li, Wall Street Is Destroying The American Dream. Breaking Points w/James Li, Feb 5, 2023.

La Toya Tanisha Francis and Patrick Rael, Mentha Morrison: A Story of Debt Peonage in Jim Crow Georgia. Black Perspectives, Oct 4, 2018. “Mentha Morrison wanted her husband back. The problem was not domestic, it was legal. Jackson Morrison owed the state of Georgia $100—likely the consequence of some petty or imagined infraction of the Jim Crow South’s endless litany of legal restrictions on the poor. A large sum for anyone in 1901, the debt would have seemed insurmountable for an impoverished African American farm worker in the Black Belt.”

Britannica ProCon, Reparations for Slavery – Top 3 Pros and Cons, Britannica ProCon, May 22, 2023.

Warren Blumenfeld, We Still Need Affirmative Action Regardless of What the Supreme Court Dictates. The Good Men Project, Jun 30, 2023. A clear understanding and presentation of how actual affirmative action policies work, and why reparations would be the full expression of restitution and apology.

David Conn and Kalyeena Makortoff, Lloyd’s of London Slavery Review Review Fails to Settle Heated Question of Reparations. The Guardian UK, Nov 8, 2023. The insurance titan Lloyd’s of London, multibillion pound cornerstone of the City’s wealth, power and renown, has taken steps since 2020 to admit its immense historic involvement in slavery, and has published powerful research on the evidence in its archives. Kalyeena Makortoff and David Corn, Lloyd’s of London Accused of ‘Reparations Washing’ Over Response to Slave Trade Review. The Guardian, Nov 8, 2023. it stopped short of offering reparations, which compensate the descendants of individuals affected by wrongdoing. Instead, the insurance market – which reported a £769m loss in 2022 but made a profit of £2.3bn a year earlier – said it was committing £52m towards a “programme of initiatives” including those that would help people from black and ethnically diverse backgrounds to “participate and progress from the classroom to the boardroom”. That includes about £12m aimed at recruiting more people from diverse backgrounds into the insurance industry, and supporting charities focused on social mobility. Meanwhile, it will earmark £40m towards profit-making investments in the African Development Bank and the Inter-American Development Bank, which has programmes in the Caribbean.

Coby Lefkowitz, Why Small Developers Are Getting Squeezed Out of the Housing Market. Noahpinion | Substack, Mar 1, 2024. Why small developers are getting squeezed out of the housing market: The use of debt leveraging by housing developers.

Sam Pollak, The Looting Of America’s Affordable Housing Fund. The Lever, Mar 5, 2025. “Private equity firms are diverting billions from a Great Depression-era mortgage program — and making huge profits.” Arguably evidence that we need a public option for banking, especially mortgage lending. Backstopping private lenders creates too many opportunities for those private lenders to exploit the system.

During the Great Depression, as the rate of foreclosures reached a thousand per day and millions of Americans were pushed out of their homes, Congress passed the 1932 Federal Home Loan Bank Act, which established a discount banking system to encourage financial institutions to initiate mortgage transactions, also known as originating mortgages.

With a balance sheet reaching $1.3 trillion, the Federal Home Loan Bank System is the country’s second-largest issuer of debt behind the Treasury Department. It originally comprised a dozen regional banks scattered across the country that provided cheap loans to local mortgage lenders. Those mortgage lenders would package the loans into low-interest mortgages for homebuyers who otherwise could not afford a mortgage. The regional banks are cooperatively owned by their member financial institutions, which purchase shares in the banks in order to borrow from them.

The Federal Home Loan Bank System is a government-sponsored enterprise with a housing mission similar to the companies Fannie Mae and Freddie Mac. But while Fannie Mae and Freddie Mac buy and sell mortgages from banks and credit unions, the Federal Home Loan Bank System’s main purpose is to provide liquidity to member institutions so that those institutions can provide mortgages.

Home loan bank membership was initially limited to savings and loans institutions, also known as “thrift banks,” as well as insurance companies, which sold mortgages at the time. But in the 1980s, as thrift banks saw widespread failure due to risky investment practices, the federal home loan banks began losing too many members to sustain themselves.

In response, Congress overhauled the system. Through the Financial Institutions Reform, Recovery, and Enforcement Act of 1989, Congress invited commercial banks and credit unions to become members of the Federal Home Loan Bank System.

The legislation also loosened rules requiring members to pledge residential mortgages as collateral in case they couldn’t pay back their loans. Now, members are able to pledge a wider range of collateral, including commercial loans, mortgage-backed securities, and government securities. That change has clouded the oversight on how the loans are used, said Sharon Cornelissen, director of housing for the consumer advocacy nonprofit Consumer Federation of America.

The legislation also introduced the system’s affordable housing program, which requires each regional bank to allocate 10 percent of its net earnings each year to grant programs that fund affordable housing initiatives in each of the bank’s regions.

Membership in the Federal Home Loan Bank System subsequently swelled. There are now more than 6,500 members of 11 regional banks, with commercial banks comprising more than half of that number. The system is expected to have received $7.3 billion in public subsidies in 2024 alone, according to the nonpartisan Congressional Budget Office.

The banks’ activity now reflects little of their original mission, and instead have together become a “Frankenstein Institution” that serves private interests, said Jared Gaby-Biegel, a research associate for the United Food and Commercial Workers (UFCW) union.

Home loan banks have become a go-to source for banks looking for quick cash: The system became a backstop to save financial institutions from failing during the 2008 financial crisis while over three million homeowners filed for foreclosure. During the regional banking turmoil of March 2023, as banks invested in risky cryptocurrency ventures, the home loan banks of San Francisco and New York lent roughly $58 billion to four banks — Silicon Valley Bank, Silvergate Capital Corp., Signature Bank, and First Republic Bank — before all four of those banks folded.

While the system’s affordable housing program is one of the largest sources of grant funds for affordable housing in the U.S., allocating $8 billion for affordable housing development since the program’s founding, the amount the banks contribute to the program pales in comparison to how much the system pays in dividends to its members. In 2022, affordable housing program contributions were assessed at $355 million, while the system paid out $1.4 billion in dividends. By 2023, the system paid out a record $3.4 billion in dividends to its members.

Race: Topics:

This page is part of our section on Race, which contains the following:

Church and Empire: Topics:

Race is a construct created by European colonialism. For more background, consider the Church and Empire section of our website. This section reminds us what Christian faith was like prior to colonialism, and in resistance to colonialism, to show that Christianity is not “a white man’s religion.”