Christian Restorative Justice, Banking, and Finance

Picture credit: Unknown | CC0.

Introduction

These resources on Banking and Finance explore moral and ethical problems found primarily in the American financial system. They highlight God’s creation order and its meaning as God’s vision for relationships between human beings, and also between human beings and the created world. See below for specific focus areas within the realm of Banking and Finance.

Messages and Resources on Christian Restorative Justice, Banking, and Finance

Christian Restorative Justice: Financial Reform

A message given to New Hope Fellowship Baltimore, MD, May 2015. This explores multiple biblical passages criticizing interest rate lending. Not only was such behavior exploitative of people in poverty, even if they “consented” to their own exploitation, it reflected a relational dynamic that cannot be grounded in the Trinitarian relations between Father, Son, and Holy Spirit. See also the ppts.

Other Resources on Christian Faith, Banking, and Finance

Distributist Review (website), a Catholic online journal

Wikipedia, Mondragon Cooperative (Wikipedia article) about a Christian community in the Basque, Spain region formally started in 1956 and running on the Catholic social teaching

Ethics Driven Innovation (website) a consulting company; and Profit With a Higher Purpose (website), a blog by the founder

Americans for Fairness in Lending, The History of Usury (Americans for Fairness in Lending website) relying on James M. Ackerman, Interest Rates and the Law: A History of Usury (1981)

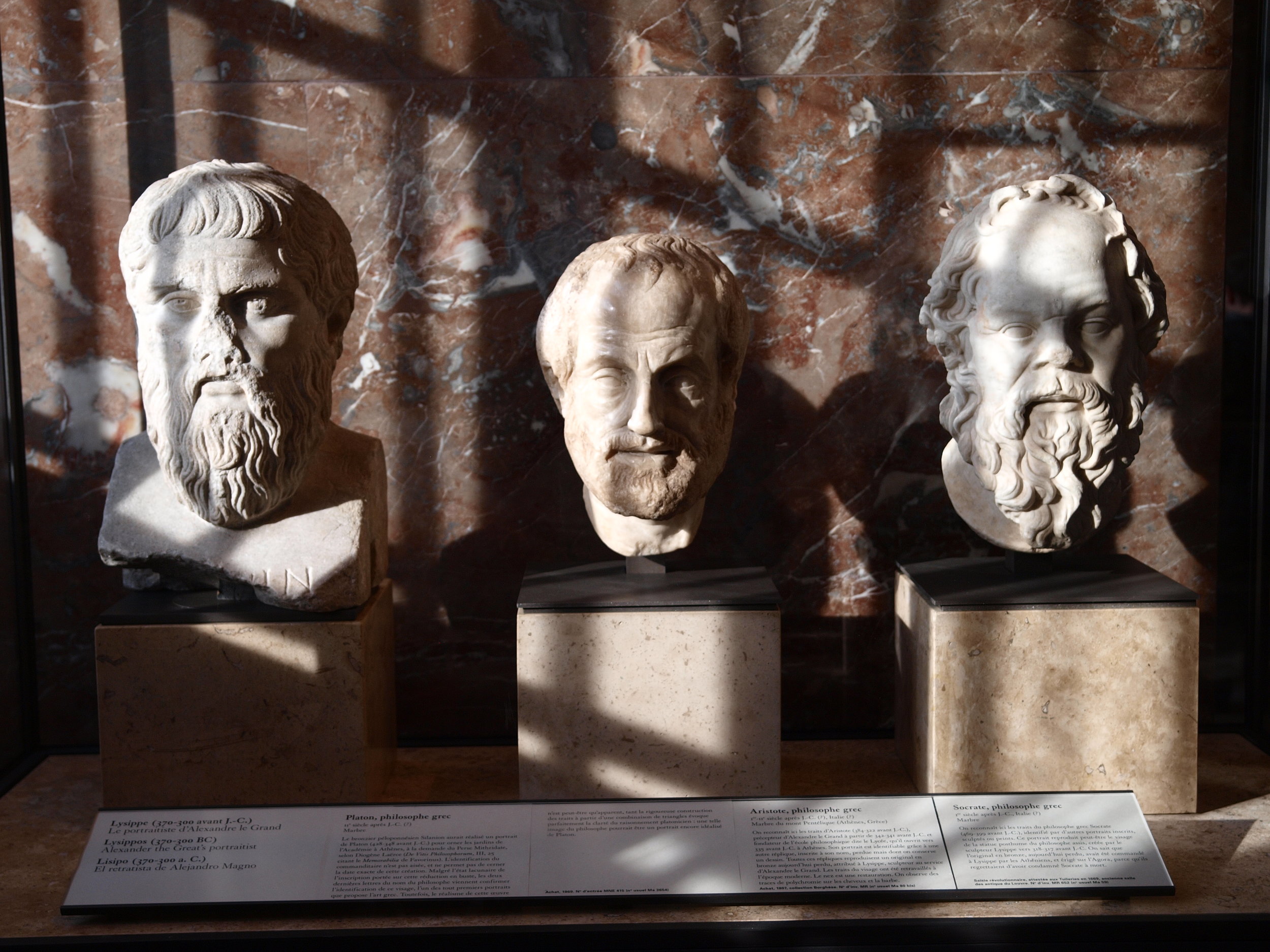

Lumen Learning, Western Europe, Ch.8: Charlemagne’s Reforms (Lumen Learning) notes:

“Early in Charlemagne’s rule he tacitly allowed the Jews to monopolize money lending. When lending money for interest was proscribed in 814, being against Church law at the time, Charlemagne introduced the Capitulary for the Jews, a prohibition on Jews engaging in money lending due to the religious convictions of the majority of his constituents, in essence banning it across the board, a reversal of his earlier recorded general policy. In addition to this macro-oriented reform of the economy, Charlemagne also performed a significant number of microeconomic reforms, such as direct control of prices and levies on certain goods and commodities.

His Capitulary for the Jews, however, was not representative of his overall economic relationship or attitude toward the Frankish Jews, and certainly not his earlier relationship with them, which had evolved over his lifespan. His paid personal physician, for example, was Jewish, and he employed at least one Jew for his diplomatic missions, a personal representative to the Muslim caliphate of Baghdad. Letters have been credited to him inviting Jews to settle in his kingdom for economic purposes, generally welcoming them through his overall progressive policies.”

Timothy Gorringe, Capital and the Kingdom. Orbis Books | Amazon page, Mar 1994.

Wayne A.M. Visser and Alastair McIntosh, A Short Review of the Historical Critique of Usury. Accounting, Business & Financial History 8:2, July 1988.

Timothy Gorringe, Fair Shares: Ethics and the Global Economy. Thames & Hudson | Amazon page, Jun 1, 1999.

Norman G. Kurland, The Just Third Way: Basic Principles of Economic and Social Justice. Center for Economic and Social Justice website, May 28, 2004.

Jeff Dietrich, The Sin of Usury. UTNE, Oct 9, 2007.

Thomas Storck, Is Usury Still a Sin? originally Distributist Review magazine, fall 2009.

Stephen Pope, Restorative Justice as a Prophetic Path to Peace. CTSA Proceedings, 2010.

Thomas Storck, Is the Acton Institute a Genuine Expression of Catholic Social Thought? Distributist Review magazine, July 4, 2011.

Angus Sibley, The "Poisoned Spring" of Economic Libertarianism: Menger, Mises, Hayek, Rothbard: A Critique from Catholic Social Teaching of the 'Austrian School' of Economics. CreateSpace Independent Publishing | Amazon page, May 2011. See also review by Michael Sean Winters. National Catholic Responder, Jul 6, 2011.

Paul Mills and Michael Schluter, After Capitalism: Rethinking Economic Relationships. Jubilee Centre, 2012.

Paul Mills at the Jubilee Centre, The Great Financial Crisis: A Biblical Diagnosis, Jubilee Centre website article, 2012.

Paul Mills, Jenny Corbett, Colin Mayer, Losing Interest: Imagining a Financial System Without Debt. Veritas Forum video, May 3, 2012. on usurious debt as a theological and relational problem, and my written notes

Michael Hoffman, Usury in Christendom: The Mortal Sin that Was and Now is Not. Independent History and Research | Amazon page, Nov 2012.

Ilsup Ahn, Deconstructing the Economy of Debt: Karl Marx, Jurgen Habermas, and an Ethics of Debt. Trans-Humanities, Vol.6 No.1, Feb 2013.

Thomas Storck, Aquinas on Buying and Selling. originally Distributist Review magazine, May 14, 2013.

Aaron Souppouris, The Church of England Wants to Oust Loan Sharks by Competing With Them. The Verge, Jul 26, 2013.

Paul Mills, The Rise of the New Slavery: Battling Debt in the 21st Century. Jubilee Centre website video, Oct 2013.

Joseph Gleason, The Bankers' Witching Hour. The Orthodox Life blog, Dec 16, 2013.

Shai Secunda, Finance in Religious Law: A Comparative Conference of Judaism, Christianity, Islam. Harvard Law School, Dec 2013.

Jamie Doward, Church of England Launches Credit Union Network in Payday Loans Fight. The Guardian, Feb 22, 2014.

Eberhard Arnold, The Economy of the Early Church: Why the Early Church Abandoned Private Property. Plough, Jan 5, 2015.

Aaron Weaver, Religious Groups Announce Coalition to Combat Predatory Lending. Cooperative Baptist Fellowship blog, May 14, 2015.

Rebecca Robbins, Churches Step In With Alternative to High-Interest, Small-Dollar Lending Industry. Washington Post, Jan 9, 2015.

Tom Strode, Payday Loans Targeted by ERLC, Others in Coalition. Baptist Press, May 15, 2015.

Paul Langley, Liquidity Lost: The Governance of the Global Financial Crisis. Oxford University Press | Amazon page, 2015. Langley is not a Christian author that I know of, but this book discusses how Anglo-American bankers and politicians at the Fed and Wall Street defined the financial crisis of 2008. They defined it in terms of “liquidity” with regards to the U.S. housing market. This diagnosis already implied an answer: “quantitative easing,” i.e. the printing of more money. But they defined the crisis in terms of “risk of default” with regards to Greece, to which the answer was “austerity.” This suggests that some financiers get to define problems and solutions for political reasons. It also strongly suggests that the whiteness of Anglo-American banking and capital interests will not easily be changed.

Rebecca Robbins, Churches Step In With Alternative to High-Interest, Small-Dollar Lending Industry. Washington Post, Jan 9, 2015.

Kerry Bolton, Tradition and Usury: The Perennial Conflict. Katehon blog, Feb 16, 2016.

Katehon, Current World Debt Crisis and Its Geo-Economic Implication. Katehon, Apr 8, 2016.

Katehon, Russian Orthodox Church Against Liberal Globalization, Usury, Dollar Hegemony, and Neocolonialism. Katehon, May 26, 2016.

Rodney Foxworth, Do Good by Giving Up More: A Vision of Restorative Investing. Medium, Nov 26, 2018. "We live in an urgent time: duopolies and monopolies greatly suffocate the growth of small, local businesses; tax policy overwhelmingly favors the wealthy; corporate subsidies remain a lynchpin in economic development efforts; and the racial wealth gap continues to grow exponentially. Systems changing ideas and beliefs are needed to confront today’s economic challenges”

Ed Mazza, Alexandria Ocasio-Cortez Challenges Religious Right on Specific Bible Passages. Huffington Post, May 17, 2019. re: usury; but she defines “usury” as “excessive” interest rates, not “any” rate, which is the truly biblical definition; nevertheless, AOC engages the conservative Christians on the right grounds. Callum Paton, Alexandria Ocasio-Cortez Is Right - The Bible Denounces High Interest Rates. Newsweek, May 17, 2019. does a better job reporting the biblical and quranic background, covering Judaism, Christianity, and Islam, but the title is nevertheless misleading, as the Bible denounces all interest rates.

Peter Balonon-Rosen, Her Church Asked Her to Pay Someone Else’s Debt. She Was In.. Marketplace, Nov 19, 2019.

Father Mark, The Sin We Stopped Feeling Sorry For. Holy Trinity Greek Orthodox Church in Lansing, Michigan, Jan 20, 2020. interest rate lending

Henry Abramson, Jews and Finance in the Medieval Period (Jewish History Lab). Henry Abramson, May 2, 2021. Abramson highlights very important and sobering and regrettable dynamics of how Western European Christendom assigned Jews the role of moneylender with interest. This made the credit market possible but the backlash was focused against the Jews. This is one reason why community, public banking as opposed to private banking, is so important to a community. See also Cultural Origins, Why King Edward I Expelled the Jews from England in 1290. Cultural Origins, Oct 24, 2021. Sadly, only the royal power protected the Jews in England while also exploiting them; when Parliament gained power, Parliament expelled the Jews. See also Sam Aronow, Jews in Medieval England (1070 - 1290). Sam Aronow, Mar 19, 2021. Aronow gives more detail and ties political events in England to those happening on the Continent.

Peg Maish, Santa Fe Church Forgives Entire State of New Mexico Medical Debt. Episcopal News Service, Jul 9, 2021.

Yves Smith, Origins of Debt: Michael Hudson Reveals How Financial Oligarchies in Greece and Rome Shaped Our World. Naked Capitalism, May 27, 2023. An illuminating overview of history, including Jewish law and Jubilee.

Christian Restorative Justice, Banking, and Finance: Topics:

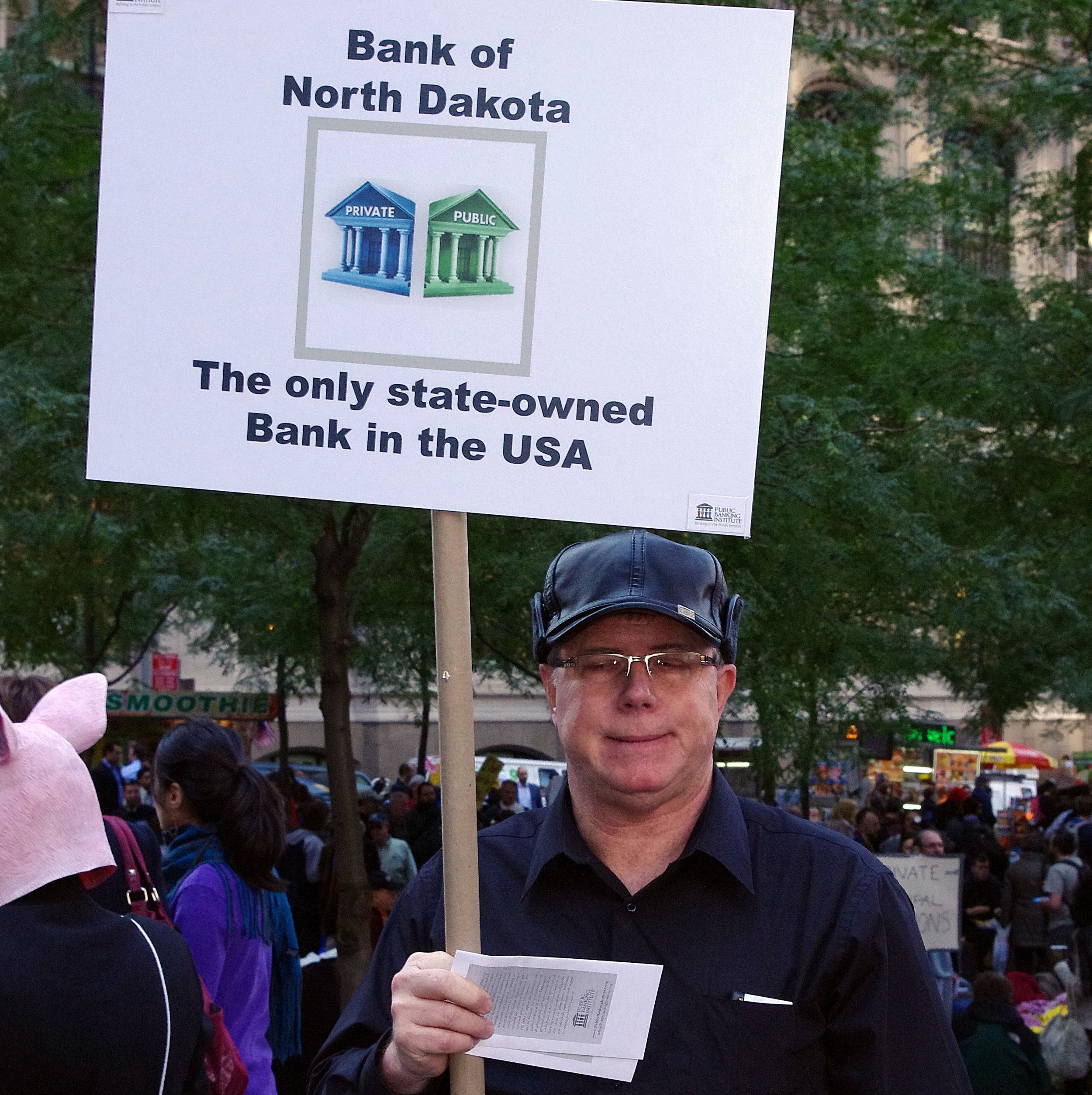

In this section, we examine the following topics: Interest Rate Lending critiques usury from multiple vantage points including the biblical, and highlights moral and economic problems associated with it. Debt Forgiveness explores the rationales and effects of forgiving debts. Corruption and Regulation demonstrates how nefarious banks and financial institutions are. Central Banks explores currency manipulation and monetary policy. Public Banks explore options like a public option for banks, postal banking, and actual examples of socialized banks. Islamic Banking examines quranic principles and examples of a different institutional framework for banking. Student Loan Debt tracks the challenges and root causes behind ballooning student loan debt in the U.S. See also Racism in Banking and Finance for resources on racism and finance.

Christian Restorative Justice Critique of the Right: Domestic Policy Topics:

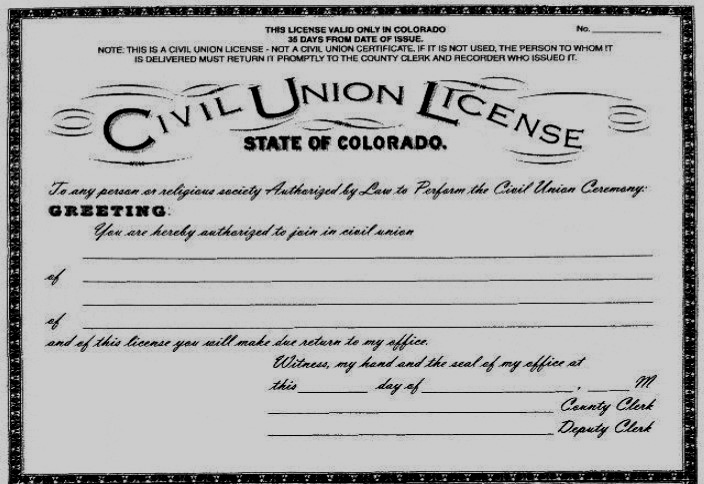

This page is part of our section Critique of the Right, which engages the following topics: Banking and Finance examines the economic and political power of financial institutions; Bioethics discusses abortion policy; Business and Economics examines economic theories, taxes, housing, environment, corporate law, labor law, automation, and inequalities of wealth and power; Civil Unions makes the Christian case for civil unions for all and removing marriage from the culture wars; Criminal Justice examines crime statistics and definition, policing, prosecution, sentencing, prisons, and reintegration; Education examines public education and conservative resistance to it; Environment and Health highlights the many challenges we face related to animals, climate change, food, and health systems; Government Corruption spotlights political compromises and dealings contrary to the public good; Gun Rights examines gun policies and rhetoric; Media spotlights failures of, and possible fixes to, left-wing or left-leaning media; Power and Politics highlights the impact of racial considerations and racism on political campaigns, voting rights, public investments, and other political procedures; Race examines the impact of white supremacy on virtually every aspect of American life.