Trade Policy

Photograph: Container ship. Photo credit: Cuaderno de Cultura Cientifica.

Christian Resources on Trade Policy

Grace Lenahan, What Catholic Social Teaching Says About Trump’s Tariffs on Canada and Mexico. America Magazine | Archive.is, Mar 3, 2025.

For the Catholic social teaching side, it’s hard to see how imposing tariffs on the developing world respects human dignity. Two specific encyclicals deal with tariffs directly. First, in the wake of decolonization in the 1960s, Pope Paul VI’s “Populorum Progressio” emphasizes the importance of just trade relationships (Nos. 58-61). For unequal countries, the market logic of fair trade is not enough. Just as C.S.T. supports minimum wages as a way to ensure that workers are paid enough to respect their dignity, C.S.T. supports just prices in trade relationships to ensure that countries receive enough income to respect their dignity.

In 2009, Pope Benedict XVI’s “Caritas in Veritate” went further. Early on, it mentions high tariffs in rich countries as a problem that hinders the economic development of poor countries. Later on, it invokes the principle of subsidiarity to talk about the most effective forms of international aid. Ideally, we must help the developing world in ways that develop their local economies. Giving those countries access for their goods and services to markets in the developing world is a good way to do that.

My dissertation research has looked at one example of this sort of development: a coffee cooperative in southern Mexico sponsored by the Mexican province of the Jesuits.

We can apply the analysis above to the specific case of a Mexican coffee farmer. One way to help him would be to buy his green coffee at a price higher than the market price. That’s what many fair trade options do. The Jesuits have gone one step further: They have built a facility so that the producers can roast and market their coffee directly in rural Mexico. This method cuts out the middleman. In the short term, both options could provide the same economic gain for the farmer, but in the long term, the second method is better according to C.S.T. because it empowers the community.

It’s hard to see how imposing tariffs on the developing world respects human dignity because global market access is what these countries need, especially countries that are sending us lots of migrants. The president of Mexico, Claudia Sheinbaum, has been vocal in some of the responses to the threat of tariffs on Mexico. One of the things she’s said is, “If even a small percentage of what the United States allocates to war were instead dedicated to building peace and fostering development, it would address the underlying causes of human mobility.”

Resources on Trade Policy

Top Resources:

Peter Zeihan, Agriculture After Globalization. Dairy West, Dec 16, 2020. A video presentation by geopolitical strategist Peter Zeihan to dairy industry professionals. Zeihan highlights why global trade is in decline largely because it was a construct of the U.S. post-WWII. Zeihan discusses cattle-specific factors between the U.S. and New Zealand, including land quality, labor, and climate change. Zeihan argues that Mexico’s population demographics indicate that their migration is unlikely to meet the needs of U.S. dairy farmers, and border crossing will decline just because of Mexico’s aging population; Central American migration is likely to be insufficient and politically difficult; Zeihan surprisingly suggests that the dairy industry lobby the State Department for war refugees as labor. This history and these stats highlight the importance of NAFTA and labor migration.

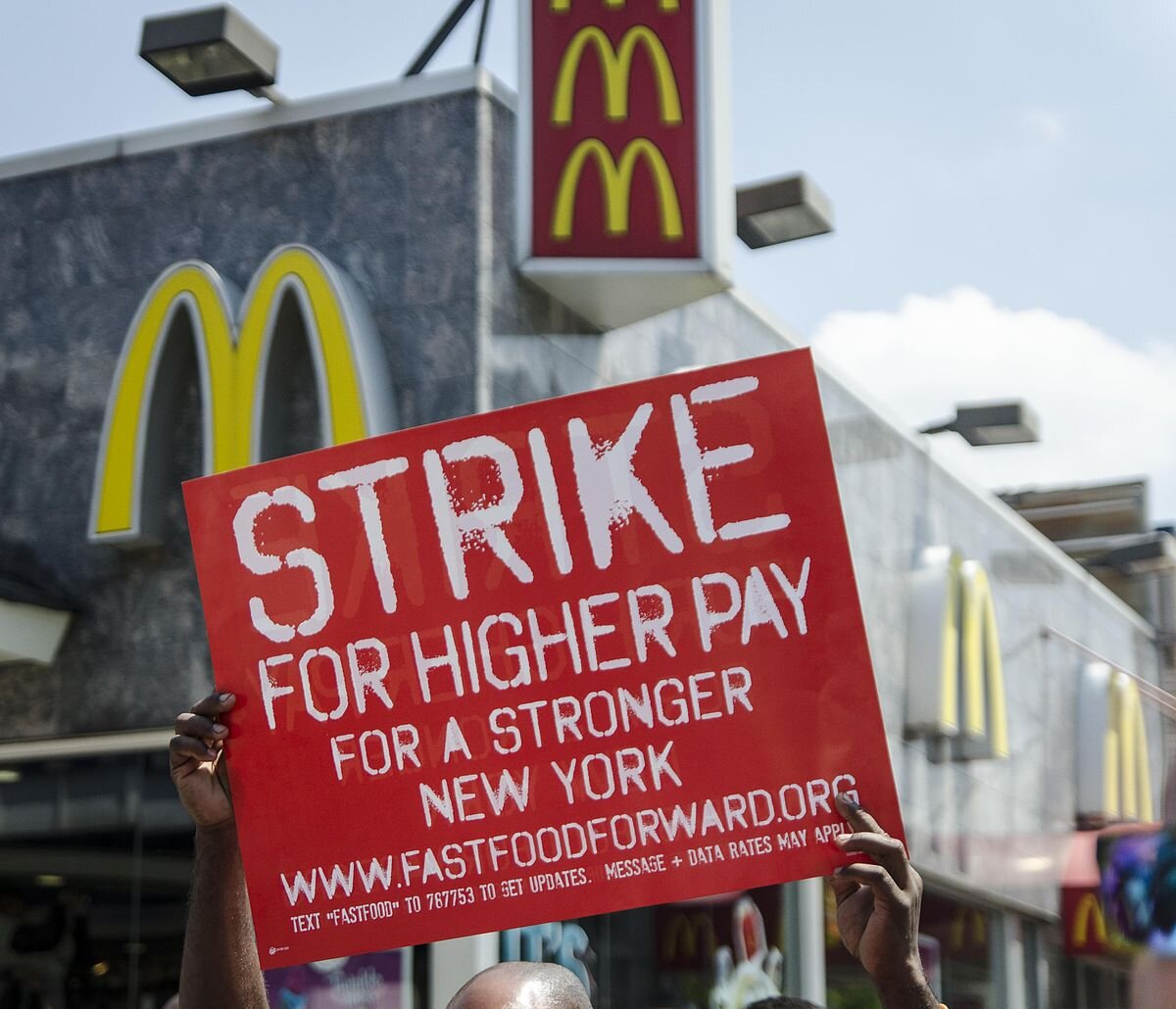

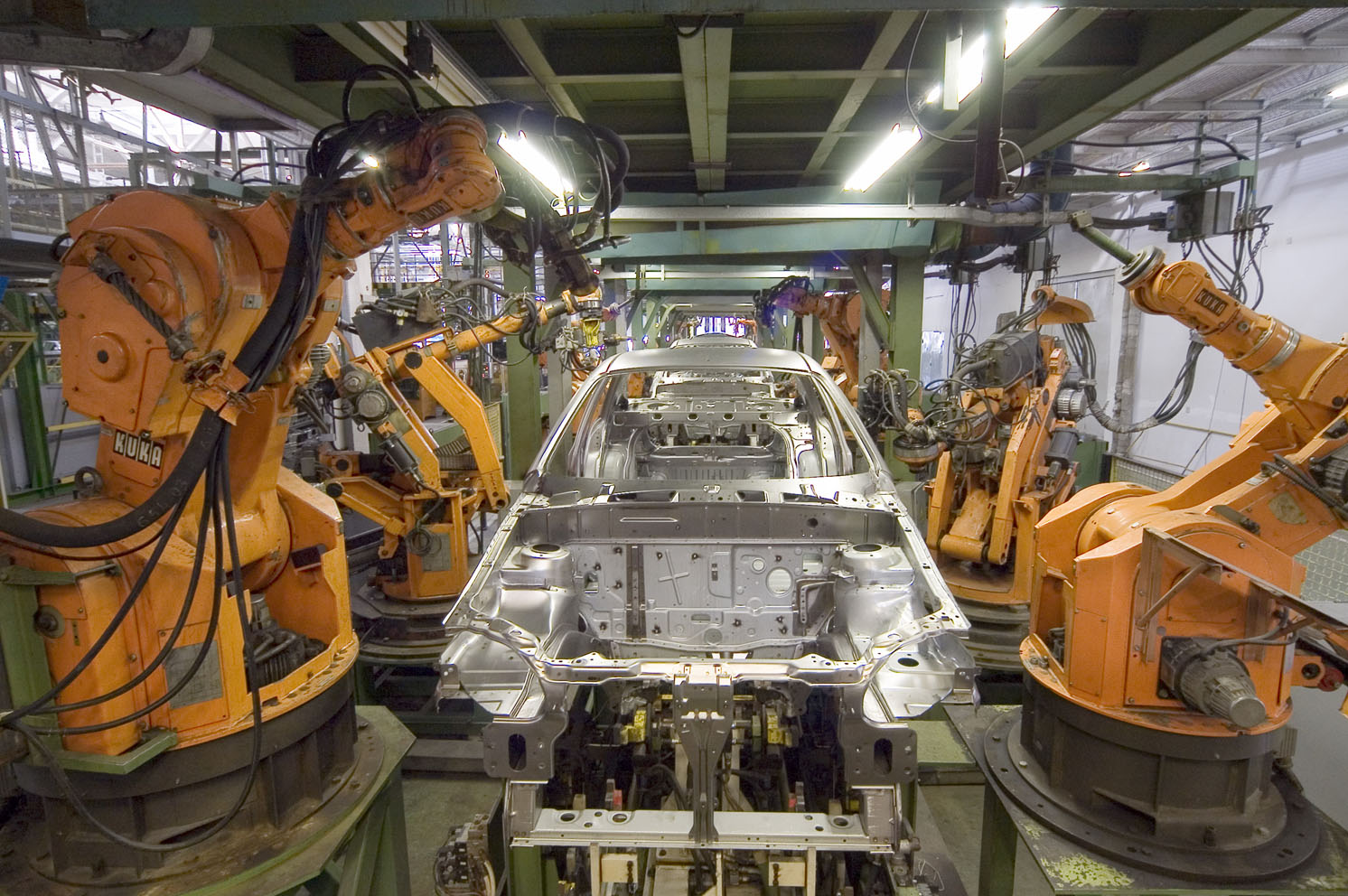

Ryan Grim, Naomi Klein: Trump NOT The Anti-Globalist We Demanded. Breaking Points, Apr 9, 2025. Ryan and Naomi reflect on the protests of the WTO from 1990s because of Chinese sweatshops. The left critiqued trade from the standpoint of corporate power over labor power. This remains the main concern of Trump’s vision. Companies don’t want to own manufacturing and support labor rights. Instead, they want to bring back jobs for robots.

Shawn Fain, Who Benefits from the Free Trade Status Quo? More Perfect Union, Apr 10, 2025. A 2.5 minute video summarizing how U.S. corporations exploit people and planet wherever they can find them, and then corrupt U.S. democracy at home.

General Resources:

Lawrence Mishel, The Trump Trade Scam. Economic Policy Institute, Jun 29, 2016.

Daniel Griswold, Globalization Isn't Killing Factory Jobs. Trade is Actually Why Manufacturing is Up 40%. Los Angeles Times, Aug 1, 2016. argues technology, not trade, is responsible for job loss

Robert Reich, Trump's Trickle-Down Populism. Huffington Post, Dec 4, 2016.

Arthur Delaney, Donald Trump Hasn’t Scared American Companies Out Of Ditching U.S. Workers. Huffington Post, Aug 30, 2018.

Annie Lowrey, Wages Are Low and Workers Are Scarce. Wait, What? The Atlantic, Sep 19, 2018.

Robert E. Scott, The State of American Manufacturing: The Failure of Trump's Trade and Economic Policies. Economic Policy Institute, Feb 5, 2019.

American Compass, Conservatives Should Ensure Workers a Seat at the Table. American Compass, Sep 6, 2020.

Nitasha Tiku, India’s Engineers Have Thrived in Silicon Valley. So Has Its Caste System.. Washington Post, Oct 27, 2020. “Engineers and advocates of the lowest-ranked castes say that tech companies don’t understand caste bias and haven’t explicitly prohibited caste-based discrimination.”

Benn Steil and Benjamin Della Rocca, 92 Percent of Trump’s China Tariff Proceeds Has Gone to Bail Out Angry Farmers. Council on Foreign Relations, Oct 28, 2020.

Saagar Enjeti, Ford Lied To Union Workers, Moving Plant From Ohio To Mexico. Rising | The Hill, Mar 19, 2021.

Richard Wolff, Economic Update: China & Inflation: Real Analyses, Not BS. Democracy at Work, Nov 1, 2021. argues that employers decide whether increases in the monetary supply translate into inflation or increased output-supply; argues that restrictive US immigration policy is causing a shortage of low-wage workers, which is causing employers to raise prices, because they must pay higher wages

Jiwon Choi, Ilyana Kuziemko, Ebonya L. Washington, and Gavin Wright, Local Economic and Political Effects of Trade Deals: Evidence from NAFTA. NBER, Nov 2021. Points out that the neoliberal agenda of free trade without an industrial policy devastated American Rustbelt areas, and turned white voters towards Trump in 2016. See commentary by Krystal Ball and Saagar Enjeti, 28 Years Of NAFTA: How It Destroyed Dems, Elected Trump. Breaking Points, Dec 9, 2021.

Phelim Kine, China Joined Rules-Based Trading System — Then Broke the Rules. Politico, Dec 9, 2021. “Four U.S. trade officials who helped plan and negotiate U.S. normalization of trade ties with China reflect what the 20 years of China's entry into WTO have meant.”

CNBC, Is Obamacare Fueling The Great Resignation? CNBC, Jan 31, 2022. Since workers don’t need their employer to provide health care, more workers feel free to not return to work.

Haley Byrd Witt, How the Uyghur Forced Labor Prevention Act Became Law. The Dispatch, Jun 20, 2022. A five part series examining the creation and passage of this law. The Smoot-Hawley Tariff is supposed to protect U.S. markets from slave-labor products, because cheap labor products undermine ethical labor.

Deutsche Welle, The Hidden Cost of Orange Juice. Deutsche Welle Documentary, Sep 12, 2022. Brazil is the world’s top supplier of orange juice, but with poor working conditions for workers.

Peter Zeihan, Uncovering Japan's Most Shocking Secret. Geopolitics in Conflict, Apr 29, 2023. Demographic decline for five decades and cost of urban living. Japanese companies since the 1900s used “desourcing” of building where they sell, which relied on U.S. maritime security.

CNBC, How Temu Makes Money From $10 Smartwatches From China. CNBC, Aug 14, 2023. Temu sells slave-made products from China. Temu threads viruses into the Temu app to prevent you from deleting the app.

Emily Jashinsky, Emily Spars With Beto O'Rourke On Immigration, Biden, Trump. Counterpoints | Breaking Points, May 17, 2024. Emily and Beto agree that US foreign policy needs to correct for past US actions towards Latin America.

Warwick J. McKibbin, Megan Hogan, and Marcus Noland, The International Economic Implications of a Second Trump Presidency. Peterson Institute for International Economics, Sep 2024.

CNBC, How China Uses Mexico To Avoid U.S. Tariffs. CNBC, Oct 25, 2024. This will be a major oversight by any tariff strategy.

Oren Cass, Making the Case for Trump’s Tariffs. Amanpour and Company, Nov 22, 2024. Cass critiques libertarian free trade, mostly by also criticizing other governments for subsidizing or protecting their companies.

Patrick Boyle, Can Trump’s Tariffs Work? Patrick Boyle, Dec 7, 2024.

Nick Dearden, Colombia Is Defending Its Sovereignty from the Power of Global Corporations. Al Jazeera, Dec 25, 2024.

“Trade deals can allow international corporations to trample over the rights of governments in the Global South. That is the message from the Colombian government, which describes the effect of such deals as a “bloodbath” for their national sovereignty. And now, Colombia’s President Gustavo Petro has said he wants to renegotiate the deals his country has with the United States, European Union and the United Kingdom. He has a strong case because, in the last couple of years, the US and European countries have also been renegotiating similar trade and investment deals, as they try to prevent themselves from being sued in the secretive “corporate courts” that these deals create. Only this year, the British government withdrew from a toxic investment deal, called the Energy Charter Treaty, after a slew of cases in which European governments were sued by fossil fuel corporations for taking climate action which supposedly damaged the profits of said businesses. So the question now is whether European countries are going to accept that southern countries need the same policy space to deal with climate change and numerous other problems they face. Or whether they will demand these countries continue to abide by these awful, one-sided deals.”

David Pakman, Oh No: Canada Targeting Red States Over Trump Tariffs. David Pakman Show, Feb 3, 2025. British Columbia is focusing on Trump-aligned red states and businesses in the US, in what seems to be a long-term strategy to lessen its dependence on the US.

Nasmat Gbadamosi, South Africa Takes on Trump. Foreign Policy, Feb 5, 2025. Top government officials threaten to withhold minerals in response to U.S. aid cutoff announcement.

Radhika Desai, Michael Hudson, and Mick Dunford, How Trump's Tariffs Will Accelerate US Decline. Geopolitical Economy Report, Feb 9, 2025.

Claire Bushey, Amanda Chu, and Gregory Meyer, ‘Cost and Chaos’: Donald Trump’s Metal Tariffs Sweep Across Corporate America. Financial Times, Feb 12, 2025. Executives grapple with uncertainty and price volatility even before levies come into effect

Keith Johnson, Trump’s Trade Wars Are Self-Defeating. Foreign Policy, Feb 12, 2025. The economic own goals are bad. The strategic backfires are worse.

Jyotishman, Will Trump Tariffs Destroy Global Economy? India and Global Left, Feb 15, 2025. “Will Trump tariffs have a huge impact on the global economy? Ben Norton breaks down the potential consequences of Trump's policies on Europe, Ukraine, Gaza, Latin America and more. Ben Norton @GeopoliticalEconomyReport discusses how Trump's policies will impact geopolitics. Get insights on the tariff war, China, Germany, and Europe, and the fall of Assad in Syria in this informative video.”

Steve Keen, "Is Trump Wrong on Tariffs?" Top Economist Warns the US. Steve Keen, Feb 21, 2025.

Rania Khalek, Trump, Europe’s Collapse & Why Liberals Keep Losing, w/ Yanis Varoufakis. BreakThrough News, Feb 22, 2025. Former Greek Finance Minister Yanis Varoufakis argues that Trump is sincere about rebuilding manufacturing in the U.S. Yanis argues that Trump will raise tariffs and then pressure other central banks to release US dollars they hold on reserve. This will depreciate the dollar, making US exports cheaper. In this short run, this might help bring down prices for US consumers. But this could also make borrowing costs higher for US companies and does not solve the problem of financial reinvestment. Varoufakis argues that Trump will have to choose between two interest groups: Wall Street finance and real estate magnates vs. the average American to revive manufacturing, and will choose the former. See shorter interview by Times Radio, Trump’s Tariff Chaos Explained | Yanis Varoufakis. Times Radio, Mar 9, 2025.

Oren Cass, The One Word that Explains Globalization's Failure, and Trump's Response. Understanding America, Feb 24, 2025.

Trump has repeatedly made clear that his frustration is with the imbalance in trade—the U.S. has an annual $1 trillion trade deficit, reflecting $1 trillion worth of goods made abroad for our consumption, which we acquire not with “some part of the produce of our own industry” but rather by sending back assets—ownership of our real estate and corporations, treasury debt that represents simply an I.O.U. to pay some day, and so on. Thus we simultaneously erode our domestic industrial capacity in the near-term and send abroad the claims on our long-term prosperity. As Warren Buffett observed, “Our country has been behaving like an extraordinarily rich family that possesses an immense farm…We have, day by day, been both selling pieces of the farm and increasing the mortgage on what we still own.”

I have generally advocated for a single global tariff, moving up or down based on the U.S. trade deficit with the world as a whole while ignoring bilateral balances. This has a couple of advantages over the reciprocal approach. One is that it is simpler to implement, and harder to game. Setting tariffs country-by-country, and re-evaluating each with some regularity, will create a lobbying bonanza and inevitable misfires and distortions. The other is that it better handles the “deficits with some countries, surpluses with others” scenario, which would be a very plausible end state if the U.S. succeeds in eliminating its overall deficit. Bringing trade into balance, while accepting variation from country to country, seems a better goal than bringing trade into balance on a bilateral basis with every country.

The reciprocal model has real benefits of its own. In the global-tariff model, no individual country has much incentive to change its own policies toward the U.S. because no reduction in a particular bilateral deficit would significantly alter the overall trade balance. The global tariff operates only at the macro level, attempting to reshape the relative attractiveness of domestic versus foreign production and acquiring U.S. goods versus assets. Reciprocal tariffs would have the macro effect, but they would also pit countries against each other in attracting U.S. business. For instance, let’s say the U.S. continues to push supply chains out of China, where will they go? Most likely to countries facing lower reciprocal tariffs. How does a country get a lower reciprocal tariff? By reducing its trade deficit with the U.S., which will require opening access to U.S. producers and encouraging the purchase of U.S. products. That would be nice.

Finally, while both global and reciprocal tariffs could help to move toward a trading-bloc system in which the U.S. and its allies maintain high levels of free and balanced trade while collectively excluding non-market and heavily distorted economies, reciprocal tariffs might get there more smoothly. Countries that do adopt fair policies and achieve balanced trade with the U.S. would naturally transition into such a bloc as tariffs among them drop toward zero, while those that do not would find themselves outside it. Ambassador Robert Lighthizer outlined this scenario in a recent New York Times essay. The final step would be for the U.S. to insist that its partners likewise impose high tariffs outside the bloc. And lo and behold, over the weekend, “Trump Team Pushes Mexico Toward Tariffs on Chinese Imports.” (On a podcast last week, C.J. Mahoney, Deputy U.S. Trade Representative in the first Trump administration, described how an updated USMCA could provide for “common external tariffs that are consistent across North America.”)

Is this what President Trump has in mind, and can his administration implement it effectively? We shall see. What is clear, regardless, is that the consensus for unilateral free trade, regardless of what other countries do, and regardless of what deficits result, has shattered. Policy should and will change accordingly.

See also Oren Cass, Stop Freaking Out. Trump’s Tariffs Can Still Work. New York Times, Apr 8, 2025.

Peter Zeihan, Trump Takes on China…or Not. Zeihan on Geopolitics, Feb 26, 2025. “China is on its last legs. Its demographic picture is far past terminal. Its financial system makes Enron look responsible. Simply feeding its people is far beyond Beijing’s capacity without legions of outside assistance.” Their labor costs have gone up dramatically, and import more agriculture than any other nation while being dependent on the U.S. Navy to patrol the sea lanes. Yet Trump’s tariff hostility against Canada, Mexico, and Europe risks reinvigorating their trade with China, and disincentivizing manufacturing companies from building in North America. Capital is less available and more costly because of aging demographics. Labor is more expensive because of mass deportation. Zeihan is thus currently pessimistic, similar to Yanis Varoufakis but for different reasons.

Ezra Klein, The Dark Heart of Trump's Foreign Policy. The Ezra Klein Show, Mar 1, 2025. Interview with journalist Fareed Zakaria. Trump views the post WWII alliance of “the West,” i.e. the U.S. and Europe and its allies, as disadvantageous to the U.S.

Lawrence O’Donnell, Canada's Trudeau Humiliates 'Cowardly' Trump Who Backs Down on Tariffs. Again. The Last Word | MSNBC, Mar 5, 2025. Lawrence adds the legal framework for tariffs: Congress authorized the President to raise tariffs for national security reasons under conditions of war. Thus, Trump is breaking the law. Trump’s tariffs on Canada and Mexico are especially ironic because they are our closest friends and allies, and because Trump himself negotiated the USMCA. See also The Editorial Board, Trump’s Tariffs Are No ‘Emergency’. Wall Street Journal, The President invokes a law that doesn’t give him power to impose sweeping tariffs. Someone should sue.

“The Constitution gives power over trade to Congress, which for most of U.S. history wrote tariff law. That changed after the catastrophe of the 1930 Smoot-Hawley tariff, as Congress said stop us before we kill the economy again and ceded authority to the President to negotiate bilateral trade deals. It ceded more power after World War II.

The President now has the explicit power to restrict imports, but only for specific reasons. The President may impose tariffs on imports that threaten national security (Section 232) or in response to “large and serious” balance-of-payments deficits (Sec. 122), a surge of imports that harms U.S. industry (Sec. 201), and discriminatory trade practices (Sec. 301).

During his first term, Mr. Trump used Section 232 to impose tariffs on steel and aluminum and 301 on goods from China. Mr. Trump’s executive orders imposing 25% across-the-board tariffs on Canada and Mexico and 10% (now 20%) on China instead invoke the 1977 International Emergency Economic Powers Act (IEEPA), which gives the President authority to address an “unusual and extraordinary threat” if he declares a national emergency. Mr. Trump deems fentanyl and other drugs such an emergency.

IEEPA’s language is intentionally broad to give the President latitude to address wide-ranging threats. But Mr. Trump’s tariffs arguably constitute a “‘fundamental revision of the statute, changing it from [one sort of] scheme of . . . regulation’ into an entirely different kind,” to quote the Supreme Court’s West Virginia v. EPA precedent distilling its major questions doctrine.

Under that ruling, Congress must expressly authorize economically and politically significant executive actions, which Mr. Trump’s tariffs undeniably are. Whether fentanyl is an unusual and extraordinary threat is debatable, however, since drugs have been pouring across the borders for decades.

The bigger problem is that IEEPA doesn’t clearly authorize tariffs. The law lets the President investigate, block, prohibit or regulate any “importation or exportation” or financial transaction involving “property in which any foreign country or a national” has an interest or “any property, subject to the jurisdiction of the United States.”

Presidents have used the law to freeze assets of foreign governments and nationals, restrict U.S. companies from doing business with them, limit export of technologies and ban imports from adversaries. In March 2022 President Biden used the law to ban imports of Russian energy, seafood and alcoholic beverages—but notably not to impose tariffs.

In April 2022, Congress gave the President authority to raise tariffs on Russia, and Mr. Biden later did. This suggests that neither Congress nor Mr. Biden believed IEEPA provided tariff authority. No President has used IEEPA to impose tariffs. The High Court has said that a “lack of historical precedent” is a “telling indication” that a broad exercise of power is illegal.

It’s true Richard Nixon used a precursor to IEEPA to impose an across-the-board 10% tariff in 1971 to address a growing trade deficit. A lower court ruled the tariff exceeded his authority by letting him “determine and fix rates of duty at will” without Congressional permission. An appeals court upheld the tariff because it “bore an eminently reasonable relationship to the emergency confronted.”

Mr. Trump’s tariff doesn’t appear reasonably related to the fentanyl emergency. And Congress seemed to dislike Nixon’s use of emergency powers to deal with trade issues since three years later it gave the President limited authority to impose tariffs. Mr. Trump may have shunned those authorities because he wants carte blanche to impose tariffs.

Mr. Trump’s tariffs recall Mr. Biden’s use of emergency power for his Covid vaccine mandate, eviction moratorium and student loan forgiveness. The Court blocked all three under its major questions doctrine, which Justice Neil Gorsuch called “a vital check on expansive and aggressive assertions of executive authority.”

Presidents of both parties are now declaring everything to be an emergency to achieve their policy goals without having to deal with a frustrating Congress. If Mr. Trump succeeds in unilaterally imposing tariffs as he sees fit, a future Democratic President will use “emergency” power for climate change and much more. Mr. Trump’s order needs a legal challenge.”

Pondering Politics, Watch Trump Get Called Out on Fox News by MAGA Economist! Pondering Politics, Mar 10, 2025. MAGA Economist Stephen Moore, who authored a book with Arthur Laffer called Trumponomics, praising Trump, warns Trump against tariffs on Fox.

Katie Millard, Intel Unlikely to Fulfill All the Promises It Made Ohio, Chip Industry Analyst Says. NBC4, Mar 12, 2025. “Lenny Siegel is the executive director of the Center for Public Environmental Oversight and a nationally accredited expert on semiconductor production and toxins. He is also the former mayor of Mountain View, California, the birthplace of Intel, Silicon Valley and semiconductor manufacturing. Siegel helped oversee the cleanup of Intel’s superfund sites in the area during his time in office, although he had monitored Intel long before. Siegel said that in many ways, Ohio’s construction delays are unsurprising. As Intel’s only entirely new development project in the U.S., it will face harsher complications than other Intel CHIPS Act projects, which are expansions or modifications, he said.”

Ezra Klein, Is Trump ‘Detoxing’ the Economy or Poisoning It? The Ezra Klein Show, Mar 14, 2025. Interview with Gillian Tett, who explores the “Mar-a-Lago Accord” idea that Trump might want to later lower tariffs and weaken the dollar in exchange for military alliances, technology exchange. Tett is a cultural anthropologist and financial reporter; see Gillian Tett, Anthro-Vision: A New Way to See in Business and Life, Amazon page, Simon & Schuster, 2022.

Lawrence O’Donnell, Trump's 'Biggest Tax Increase in History' Makes Republicans Admit 'Tariffs Are Taxes'. The Last Word | MSNBC, Apr 2, 2025. Four GOP Senators break with Trump and vote against giving him tariff authority over trade with Canada: Lisa Murkowski (R-AL), Susan Collins (R-ME), Mitch McConnell (R-KY), and Rand Paul (R-KY). O’Donnell also recounts the history of Grover Norquist’s anti-tax-increase pledge. Norquist is silent now, and all of the Republicans have broken that pledge by supporting Trump’s sales tax.

Sean Crawford, Viewpoint: Will Trump’s Tariffs Be Good for Auto Workers? Labor Notes, Apr 2, 2025. See interview with Amy Goodman and Juan Gonzalez, "What About the Capitalists?": Autoworkers in U.S., Mexico Call for Solidarity, Not Divisive Tariffs. Democracy Now, Apr 8, 2025. What about reigning in the capitalists? An interview with Sean Crawford, who authored an article in Labor Notes, arguing that Trump’s broad tariffs will not be good for workers. "They are always harping on foreigners, foreigners, foreigners. But what about the capitalists?" says Crawford, who urges international solidarity against corporations' attempts to sow division among exploited workers. "This nationalistic viewpoint has not been working for us and has resulted in a lot of these layoffs," he says. "I want to see us grow together as a working class." This interview covers important history about the US auto industry — in roughly 1950 when the US produced 80% of all the world’s cars, there was very little competition because of the devastation of WWII. So harkening back to the time of “American manufacturing dominance” is not an accurate point of reference.

Ben Norton, Trump's Tariffs Make No Sense, and Will Backfire Hard on the US Economy. Geopolitical Economy Report, Apr 3, 2025. A very in-depth analysis of the reasoning and rhetoric of the Trump administration. Ben Norton, editor in chief at Geopolitical Economy Report, is a big advocate of BRICS efforts to de-dollarize the globe and reviving US manufacturing. His main critique is that a more comprehensive industrial policy at home is needed. For example, the US did not have enough skilled labor to work at the TSMC plant in Arizona, so the Taiwanese company had to bring over half their eventual work force from Taiwan. With Trump also lowering tax rates for the wealthiest, disinvesting in public education and science research, and tearing up the CHIPS Act and the Investment Reduction Act, how will American workers fill the jobs? How will the American economy connect talent to capital to produce the innovations? Also, why would manufacturing companies reshore in the US? Over 20 years ago, US automakers set up plants in Canada because they didn't have to pay for their workers' health insurance. Canada's national health care system took care of it. (GM in 2005, raised again by Democracy Now in 2025).

Krystal Ball and Saagar Enjeti, Krystal And Saagar React: Trump's Insane Tariff Math. Breaking Points, Apr 3, 2025. Saagar is an autarkist (nations should produce their own stuff) but is upset at the tariffs. He points out that businesses care about their stock prices falling but not as much as they care about liquidity. U.S. businesses are going to take an extraordinary dose of uncertainty. So they are going to lay their workers off. By comparison, during COVID, we gave PPP loans to keep people on payroll. This tariff regime is like the COVID lockdown but without expanded unemployment relief, the CARES Act, etc. Saagar and Krystal also point out that economic stresses cause suicides, divorces, and mental breakdowns. Saagar points out that the Asia-Pacific region is going to be the largest economic region and yet Trump’s highest tariffs are reserved for it. Krystal contends that tariffs are just a way for Trump to consolidate power when corporate leaders come hat in hand to plead for special treatment -- the main goal is more political than economic, which is chilling.

Joeri Schaasfort, Why Trump’s Tariff Chaos Actually Makes Sense (Big Picture). Money & Macro, Apr 3, 2025. Economics professor Joeri Schaasfort argues that Trump wants to group nations into three categories: vassals (green, UK), neutrals (yellow, Europe), and enemies (red, China). Joeri argues that Trump is genuinely interested in re-industrialization. The U.S. de-industrialized because it wanted the dollar to be the global reserve currency and went off the gold standard to make dollars more accessible, in exchange for military protection and geopolitical alliances against the Soviet Union. A paper by theorist Stephen Miran, apparently read and held in high esteem by the Trump team, argues it is possible to keep the dollar as the global reserve currency and also re-industrialize the U.S. Step one is to create global trade chaos. Step two is reciprocal tariffs. Step three is a new "Mar-a-Lago accord" which depends on secrecy for negotiating power. Joeri speculates that it will look like Bretton Woods minus the gold, with a new vassalage system where other countries pay in economic policy tribute for military security and by pegging their currency to the U.S. dollar. But the big risk here is that Trump himself creates political chaos by reneging on very important promises, and nations might want to establish trade and treaties with one another instead of the U.S., and trust in the White House is declining.

Gary Stephenson, Special: Can Tariffs Make You Rich? with Ha-Joon Chang. Garys Economics, Apr 3, 2025. Development economist Ha-Joon Chang joined British economist Gary Stephenson in an interview. Chang explores why tariff protectionism for a young, fledgling economy or industry makes sense, but is questionable or even counterproductive for a mature economy like the US. Chang argues pointedly that the U.S. financial system is parasitic and extracts investment capital. They will look for higher returns elsewhere rather than invest in US manufacturing, or people for that matter. Trump appears to be unwilling to discipline capital using tax policy or other government tools.

Ed Elson, A Nightmare Tariff Scenario for the Auto Industry — ft. Tim Higgins. Prof G Markets, Apr 3, 2025. Ed Elson points out how Trump is lying about the U.S. being the “victim” of tariff policies from other countries. From 2009 - 25, the U.S. has implemented 10,829 trade interventions harmful to other countries, compared to 3,762 from Germany, 2,978 from Canada, and 2,163 from France.

Kalea Hall, David Shephardson, and Nora Eckert, Stellantis to Temporarily Lay Off 900 US Workers as Tariffs Bite. Reuters, Apr 4, 2025.

Radhika Desai and Michael Hudson, Trump’s Tariffs Are Part of a Class War on His Own Base. Geopolitical Economy Report, Apr 6, 2025. Desai and Hudson believe Trump’s tariff’s policy is part of another big lie that he sold to the American people. He couldn’t say that the US economy is fine, because too many people felt pain. But he also couldn’t say that it was the result of four decades of neoliberal policy that privileged finance. So he scapegoated other countries for developing their own economies and selling products back to the US. He also doesn’t understand dollar global dominance and foreign purchase of US debt and assets as the root cause of why corporations moved their manufacturing offshore. Trump’s tariff policy will therefore likely hurt his own base the most. He misdiagnosed the problem and has a more pro-corporate, laissez faire approach to managing capitalism. So Wall Street will continue to run the US government, not vice versa.

Krystal Ball and Saagar Enjeti, US Clothing Brand Sounds Alarm Over Tariffs. Breaking Points, Apr 8, 2025. Andrew Chen from 3Sixteen, a high quality clothing maker in the U.S., discusses how Trump’s tariffs will increase his costs which he will need to pass along to consumers. Building a consumer base is a long process. Relying on particular fabrics and having a vision for longer-lasting, higher-quality clothing will become more expensive because of the fast fashion trends.

Paul Krugman, 'Damage Done' by Uncertainty over Tariffs. Bloomberg Podcasts, Apr 8, 2025.

Rachel Lerman and Douglas MacMillan, Trump Told People to Buy. Hours Later, His Tariff Pause Sent Markets Soaring. Washington Post, Apr 9, 2025. See also Krystal Ball and Saagar Enjeti, Massive Insider Trade Suspected Ahead Of Trump Pause. Breaking Points, Apr 10, 2025.

Andrew Ackerman, U.S. Treasury Bonds Are Being Sold Off. Here’s Why It’s Concerning. Washington Post, Apr 9, 2025.

Heather Long, Trump Caved on Tariffs. It Took a Scary Bond Market Freakout. Washington Post, Apr 9, 2025. The ‘safe haven’ status of U.S. Treasuries is under review in the Trump era.

Ryan Grim, Naomi Klein: Trump NOT The Anti-Globalist We Demanded. Breaking Points, Apr 9, 2025. Ryan and Naomi reflect on the protests of the WTO from 1990s because of Chinese sweatshops. The left critiqued trade from the standpoint of corporate power over labor power. This remains the main concern of Trump’s vision. Companies don’t want to own manufacturing and support labor rights. Instead, they want to bring back jobs for robots.

Scott Lincicome, He Just Likes Tariffs. The Dispatch, Apr 9, 2025.

One Wednesday, Donald J. Trump used one of the world’s largest megaphones to announce his bold plan to end vast U.S. trade deficits, lower income taxes, and boost growth by taxing foreign nations that have cheated on trade to enjoy unprecedented surpluses at America’s expense.

The year was 1987.

Trump’s comments appeared in a full-page ad that ran in the September 2, 1987, print editions of the New York Times, the Washington Post, and the Boston Globe, but they could’ve been printed almost verbatim today. Back then, of course, Japan—not China (“CHYNAH”)—was the target of Trump’s trade ire, but the ad’s themes are almost identical to those on display at Trump’s now-infamous Rose Garden unveiling of his grand “reciprocal tariff” regime—the culmination (for now, at least) of two months of executive branch actions that would’ve increased the scope of U.S. tariffs by almost tenfold.

Since that announcement, markets have gyrated wildly, while dozens of White House officials, media surrogates, and online personalities have offered a wide range of reasons—often contradictory—for why Trump has done what he’s done (all without Congress, of course). Even Trump’s surprise decision today—pausing the worst of the new tariffs but keeping a 10 percent global one in place—is supposedly all part of the plan (whatever that may be).

In reality, however, the reason Trump’s doing this stuff is likely much simpler than what his defenders suggest: He just likes tariffs and always has, and everything else you read and hear about them is just reverse-engineered pabulum to fit (or hide) that singular motivation.

Trump’s views on immigration, health care, taxes, foreign interventionism, and many other things have changed since the 1980s, but his views on trade have never wavered: It’s a zero-sum game; trade balances tell you who’s winning and losing (surplus good, deficit bad); foreign governments are cheating to win; and tariffs—beautiful tariffs!—can turn the tide in America’s favor, boosting jobs, exports, and growth along the way. He said as much in that newspaper ad; he said it again three years later in a long interview with (lol) Playboy magazine; and he’s said it—in public and private—dozens of times since then, especially during his first term as president. Trump even went so far, Bob Woodward documented in his book, as to famously scribble “TRADE IS BAD” in the margins of a draft presidential speech…

These beliefs were not, moreover, mere rhetoric. They were central to many of Trump’s first-term trade policies. Beyond imposing tariffs on imports of steel and aluminum, washing machines, solar panels, and Chinese goods, Trump’s trade deals reeked of mercantilism (imports are bad; exports are good). His renegotiation of the U.S.-Korea Free Trade Agreement, for example, expanded the South Korean government’s quota on American automobile exports and included new U.S. restrictions on Korean steel and pickup trucks. His mini-deal with Japan, meanwhile, reduced Japanese tariffs on U.S. agricultural exports but did almost nothing on the U.S. side (while maintaining U.S. metals tariffs). His NAFTA renegotiation included some modest trilateral trade liberalization but ignored most U.S. trade barriers and introduced new, protectionist regulations of Mexican labor and environmental practices and of Mexican automotive manufacturing. And his “Phase One” deal with China didn’t eliminate any U.S. (or Chinese) tariffs but instead focused on guaranteed Chinese purchases of U.S. exports to reduce the U.S.-China trade deficit.

These beliefs also motivated Trump’s new “reciprocal” tariffs. As the Washington Post reported last week, the president “personally selected” the new tariff regime, which includes both a 10 percent global tariff and now-paused higher tariffs on imports from countries with which the U.S. has a bilateral trade deficit—a reasonable proxy, Trump’s trade representative asserts, for unfair trading practices abroad. As one White House official put it in the New York Post, the higher tariff rates assume that "the trade deficit that we have with any given country is the sum of all unfair trade practices, the sum of all cheating." Trump himself said much the same aboard Air Force One over the weekend:

I spoke to a lot of leaders—European, Asian, from all over the world. They are dying to make a deal, but I said 'we're not gonna have deficits with your country' ... to me a deficit is a loss. We're gonna have surpluses or at worst we're gonna be breaking even.

The Post adds that, per various insiders, Trump has also been unmoved by the recent market chaos because “he is determined to listen to a single voice—his own—to secure what he views as his political legacy,” one centered on the view that sees “import duties as necessary to revive the U.S. economy.”

Why Trump thinks this way is anyone’s guess.”

Noah Smith, All the Arguments for Trump's Tariffs Are Wrong and Bad. Noahpinion | Substack, Apr 9, 2025. The President's defenders are flailing. Economist Noah Smith, who is an advocate of treating China as an economic adversary, for reshoring manufacturing especially critical technology for industry and the military, for limited tariffs, and for stronger labor and environmental policy, critiques all the justifications Trump’s team have given. They are mistaken on their own, and self-contradictory when taken together.

Eurodollar University, This Could Trigger a Full-Blown Global Liquidity Crisis. Eurodollar University, Apr 10, 2025. Argues that the Repo market at the Fed shows signs of the crisis of dollar illiquidity. Also argues that the media receives news from the Fed and other central banks, who are invested in hiding crises and warning signs.

TLDR News Global, Could China Dump its US Treasuries? TLDR News Global, Apr 10, 2025.

KDKA News, Microsoft Says It’s ‘Slowing or Pausing' Some AI Data Center Projects, Including $1B Plan for Ohio. CBS News, Apr 12, 2025.

Farm Action, Rethinking Tariffs: Let’s Talk About What’s Really Happening with Ag Trade. Farm Action, Apr 14, 2025.

In 2019: For the first time in more than 50 years, we bought more agricultural products from other countries than we sold to them. And it’s been happening more often since then. The latest numbers predict we will have a record $49 billion agriculture trade deficit this year. It makes you wonder if we’re still the farming powerhouse we used to be.

One example of the counterproductivity of the current across-the-board tariffs is those proposed on South Korea and Turkey while the USDA’s avian flu strategy depends on importing eggs from these countries to rebuild our supply and bring down prices. Placing tariffs on those eggs when they enter the U.S. will only drive up the prices. Additionally, when we put broad tariffs on goods, other countries often do the same to us—or worse, stop buying from us altogether. We saw this during the first Trump administration’s trade war with China, a country we rely on to buy the bulk of our corn and soybean exports. China imposed steep retaliatory tariffs on the U.S. and turned to other trading partners to fill their needs for those goods—and we’ve still not reopened many of the markets that were closed to us.

Instead of implementing broad tariffs, we could support farmers with strategic, targeted tariffs. For example, tariffs on imported beef, lamb, fruits, and vegetables could help our farmers growing and raising those products get back on their feet. This would also make our food supply more secure and help American families access foods grown closer to home.

But a targeted tariff strategy must also be accompanied by better support for local food systems and family farmers growing food for our communities. Today, the majority of agriculture subsidies and programs currently support the production of corn and soybeans, while only 4% of those funds go to fruit and vegetable farmers. This is irresponsible government spending…

The Trump administration must change its current approach to trade and abandon the use of outdated broad tariffs that do not work in today’s heavily consolidated marketplace.”

Scott Galloway and Jessica Tarlov, The Art of the Trade War. Raging Moderates, Apr 15, 2025. A withering critique to date. China’s tariff on US goods is 125% and Trump responded with 145%. Trump’s economic approval rating has dipped to 44% approve vs. 56% disapprove. The bond market continues to express disapproval and skepticism with Trump’s tariff’s policy because interest on bonds has increased, increasing the amount that the US needs to repay its debt. The woman who won the Shark Tank business competition for her silicone baby placemats is now explaining that she will probably be going bankrupt and considered ending her life. People feel more uncertainty than during COVID. Companies are pausing hiring plans. The 10 year Treasury popped almost 50 bips, meaning we owe $3.5 billion in interest payments for every bip (0.01 increase), thus $175 billion in interest costs alone. If the economy is slowing while interest rates are going up, that produces a vicious cycle leading to staglation. If we try to print more dollars, and these are fewer goods because other countries have stopped supplying to the US, we could have runaway inflation. At the 19:50 minute mark, Jess discusses the feasibility of tariffs bringing back manufacturing. The Cato Institute says from a survey that although 80% of Americans want to have more manufacturing jobs in the US, 73% of people say they do not want to do those jobs. Our unemployment is at 4% which means that we don’t have the people to do those jobs. Since 1994, we have lost 5 million manufacturing jobs and gained 12 million in professional services, in air conditioned offices or homes. Scott points out that in the late 19th century, we had child labor and terrible conditions. Today, there are 6 times as many job openings as people looking for jobs. We have a skills mismatch. You can’t find American workers to work outside, in construction or agriculture. Have we left people behind in the skillshift? Yes, but tariffs don’t fix that. And, can we hurt China? Both China and the US have been diversifying away from each other, but China has been doing it faster. China’s largest trading partner-blocs are ASEAN (Southeast Asia) at a trillion and the EU at 900 billion, then the US. And, the US citizenry is not accustomed to pain. Trump meanwhile rails against deals that he did himself, like the USMCA and he canceled the Trans-Pacific Partnership which had Vietnam, South Korea, and Japan just because Obama put it in place.

Krystal Ball and Emily Jashinsky, Bill Burr's Shockingly Good Robber Baron History Rant. Breaking Points, Apr 16, 2025. Bill Burr points out that corporate leaders used people’s labor in sweatshops until the labor movement. But they pursued much cheaper labor and outsources manufacturing to other countries. This is relevant because to bring back manufacturing jobs to the US, oligarchs are not willing to honor labor unions and pay much higher wages.

Ben Norton, Trump's Trade War Immediately Failed: China Is Much Stronger Than USA Thinks. Geopolitical Economy Report, Apr 16, 2025. Ben argues that Trump is using tariffs to offset income taxes for the rich, and for political power reasons. Trump’s exceptions for electronics also make no sense geopolitically because they will not reshore manufacturing. Ben reviews details about China’s trade advantages.

Scott Galloway, Canada’s Role in a Shifting Global Order — with Mark Carney. Prof G Conversations, Apr 17, 2025. Mark Carney, Canada’s 24th Prime Minister and leader of the Liberal Party, joins Scott to discuss the country’s economic outlook, how Canada fits into a shifting global order, and whether the U.S.-Canada relationship can be repaired amid rising trade tensions. Canada is the #1 trading partner with the U.S.

Kyle Kulinsky and Krystal Ball, China Has Already Won Trump's Trade War. Krystal, Kyle, and Friends | Secular Talk, Apr 18, 2025. Interview with Ben Norton from Geopolitical Economy Report, who gives a great update. Trump’s tariff policy has failed on its own stated goals. A 22 minute video.

Katya Schwenk and Luke Goldstein, How Trump Is Helping Price Gougers Exploit His Tariffs. The Lever, Apr 19, 2025. Emboldened by the new administration’s regulatory reprieve, “price optimization” consultants are showing corporations how to weaponize import levies to fleece consumers.

Timothy W. Rybeck, Hitler’s Terrible Tariffs. The Atlantic, Apr 20, 2025. “By seeking to “liberate” Germans from a globalized world order, the Nazi government sent the national economy careening backwards.”

Julian E. Zelizer, Tariffs Aren’t Enough to Bring Back the Glory Days of U.S. Manufacturing. Foreign Policy, Apr 21, 2025. “Job security and economic benefits came about because of unions.” The larger issue is the directing and disciplining of finance. See also archived copy.

More Perfect Union, Trump Promised American Jobs. Why Are These Truck Jobs Going To Mexico? More Perfect Union, Apr 24, 2025. A 13 minute video. Trump promised to save American jobs. Mack Trucks is calling his bluff. Mack announced it’s building a new plant in Mexico, and laying off 350 U.S. workers in PA. Workers tell us the solution isn’t Trump’s chaotic tariffs. It’s a North American minimum wage.

Kate Aronoff, Trump’s Policies Are Bad News for His Favorite Industry. The New Republic, Apr 25, 2025. “Low oil prices, tariffs, and other pro-drilling policies could wreck the oil industry far faster than the Democratic policies Trump loves to complain about.”

David Floyd, FreightWaves CEO Weary of Trump’s Tariffs. Chattanooga Times Free Press, Apr 29, 2025.

Krystal Ball and Saagar Enjeti, Warren Buffett Issues Final Warning, Hoards Record Cash. Breaking Points, May 5, 2025. Buffett believes economic prosperity can be shared, and is against Trump’s blanket tariffs.

Eurodollar University, The Global Currency Crisis Is Worse Than Anyone Expected. Eurodollar University, May 6, 2025. Currency flight to the Swiss franc and the Hong Kong dollar is a flight to safety.

Ryan Grim and Emily Jashinsky, Yanis Varoufakis Reveals Real Trump Tariff Strategy. Breaking Points, May 6, 2025. Yanis argues that Bessent wants to tell Japan and China to sell their Treasuries but not to buy the Yen and RMB. As background, Yanis explains “the Nixon shock,” when his administration devalued the dollar so fast that his Treasury Secretary John Connolly said to the Europeans, “The dollar is our currency, but it is your problem.” Nixon imposed 10% tariffs immediately, and then removed them 3 months later. Yanis then says that Germany, Japan, etc. are indeed directing capital investments to the US. But he is skeptical that many more jobs will be created, because of automation. Yanis also says that the US rentier class will be pinched, because there will not be the inflation of assets — real estate, Treasuries, and stocks — that flood into the US because of the excess of dollars from Europe, Japan, and other manufacturers. So the rentier class and asset managers will pressure Trump to stop.

More Perfect Union, What Everyone Gets Wrong About Tariffs. More Perfect Union, May 7, 2025. A 13 minute video. Industrial policy needs to incorporate national security concerns like what needs to be manufactured here, labor unions like in the PRO Act, tax policy, antitrust policy.

Ben Norton, Donald Trump Is Uniting the World Against the US. Geopolitical Economy Report, May 8, 2025. In March, China signed trade declarations with Japan and South Korea. In May, China expanded that to ASEAN. In April, the EU pledged more trade with China, and the EU is China’s #2 regional export destination (#1 is ASEAN, #3 is the US), despite the close ties China maintains with Russia. Trump pledged to pull Russia away from China back in October 2024, but that has certainly not happened.

CNBC News, Why The U.S. Might Increase Duties On Canadian Lumber Again. CNBC News, May 18, 2025. “Volatile lumber prices have been causing uncertainty for construction businesses. In April 2025, the price of softwood lumber was 23% higher than the previous year. Lumber futures in the first quarter of 2025 have also surged on fears of higher duties as well as sawmill closures across North America. That has impacted some of the U.S. biggest homebuilders like Lennar, D.R. Horton and Toll Brothers all, which suffered declines in their stocks during the spring. But while lumber escaped the latest round of tariffs they are on the radar of the Trump administration. Canada accounts for about 85% of all U.S. softwood lumber imports and represents almost a quarter of U.S. supply.”

Electric, Ford Shuts Down Production In the U.S. Was It Planned? Trump Shocked! Electric, May 23, 2025. On May 17, 2025, Ford Motor Company, a pillar of American industry, stunned the nation by halting production at key U.S. plants, including Chicago and Michigan, due to President Trump’s 25% tariffs on imported parts and vehicles. Intended to bolster domestic manufacturing, the tariffs instead crippled Ford, projecting a $1.5 billion earnings hit in 2025. Thousands of workers were sent home, and communities from Kokomo to Toledo faced economic fallout as diners, shops, and suppliers felt the squeeze. The North American auto industry, a finely tuned network spanning three countries, began to fracture. Ford raised prices on Mexico-made models like the Mustang Mach-E by $2,000, while halting exports to China, losing a vital market. General Motors and Stellantis also suffered, with layoffs and idled plants rippling across the Midwest. Consumers faced a 2.5% spike in car prices, thinning inventories, and stalled deliveries. Trump called the chaos “expected,” insisting companies should relocate production, but the industry warned of a million lost sales. Wall Street recoiled, with auto stocks tumbling. As China retaliated with tariffs, American cars grew too costly abroad. Workers, caught in a political divide, questioned the “America first” promise as jobs vanished. Ford’s CEO called it a “fair fight,” but the industry braced for a lost decade. This gripping saga exposes the high stakes of trade wars, where policy clashes with reality, leaving workers and communities to pay the price.

Ben Norton, This is Why Trump’s Tariffs Will NOT Bring Manufacturing Back to the US. Geopolitical Economy Report, May 31, 2025. Trump is not directing Wall Street and disciplining investment capital. Also, Trump is disinvesting from education and industrial policy. That is tragic because the reason why China and ASEAN countries are attracting manufacturing is because of the education of their workforce and the concentration of the resulting opportunities.

Steve Keen, Top Economist: Everybody Except @SteveMiran Is Wrong on Trump’s Trade War. ProfSteveKeen, Jun 1, 2025. Argues that Miran is correct about the dollar as the global reserve currency advantaging the US financial industry and disadvantaging the US manufacturing industry, because it creates an artificially high demand for dollars. Keen argues that John Maynard Keynes envisioned the best financial payments system, which was rejected by Harry Dexter White.

Sal Mercogliano, Tankers Front Eagle and Adalynn Collide East of the Strait of Hormuz | Was GPS Spoofing the Cause? What’s Going on with Shipping? Jun 17, 2025. GPS spoofing is interference with a ship’s GPS system. This could have been electronic warfare because of the Israel-Iran War.

Matthew McManus, Free Trade Has Stronger Intellectual Roots in the Left than the Right. The UnPopulist, Jun 17, 2025. “Before the Cold War, free market liberals and Marxists both saw commerce as a force for global peace and equitable prosperity, a historian shows”

Christian Restorative Justice and Labor: Topics:

Christian Restorative Justice, Business, and Economics: Topics:

This section on Economics includes the following pages: Economics Metrics identifies and critique the metrics we use. Public-Private Partnerships defends government involvement as a permanent fixture of economic growth, historically and philosophically. Environment examines many aspects of conservation, climate change, sustainability, and human health. Taxes examines models of taxation, claims by adherents, and effects. Housing Policy highlights how housing should be considered a human right, with better planning, zoning, and accountability. Corporate Law examines monopoly, limited liability, regulation, and other features of business law. Labor highlights the importance of labor over capital investment. Automation examines the impact on people and communities. Wealth Inequality and Power Inequality track the historical ups and downs, along with the ideologies used to justify them. Media examines media companies as economic and political agents, especially rightward media.

Christian Restorative Justice Critique of the Right: Domestic Policy Topics:

This page is part of our section Critique of the Right, which engages the following topics: Banking and Finance examines the economic and political power of financial institutions; Bioethics discusses abortion policy; Business and Economics examines economic theories, taxes, housing, environment, corporate law, labor law, automation, and inequalities of wealth and power; Civil Unions makes the Christian case for civil unions for all and removing marriage from the culture wars; Criminal Justice examines crime statistics and definition, policing, prosecution, sentencing, prisons, and reintegration; Education examines public education and conservative resistance to it; Environment and Health highlights the many challenges we face related to animals, climate change, food, and health systems; Government Corruption spotlights political compromises and dealings contrary to the public good; Gun Rights examines gun policies and rhetoric; Media spotlights failures of, and possible fixes to, left-wing or left-leaning media; Power and Politics highlights the impact of racial considerations and racism on political campaigns, voting rights, public investments, and other political procedures; Race examines the impact of white supremacy on virtually every aspect of American life.